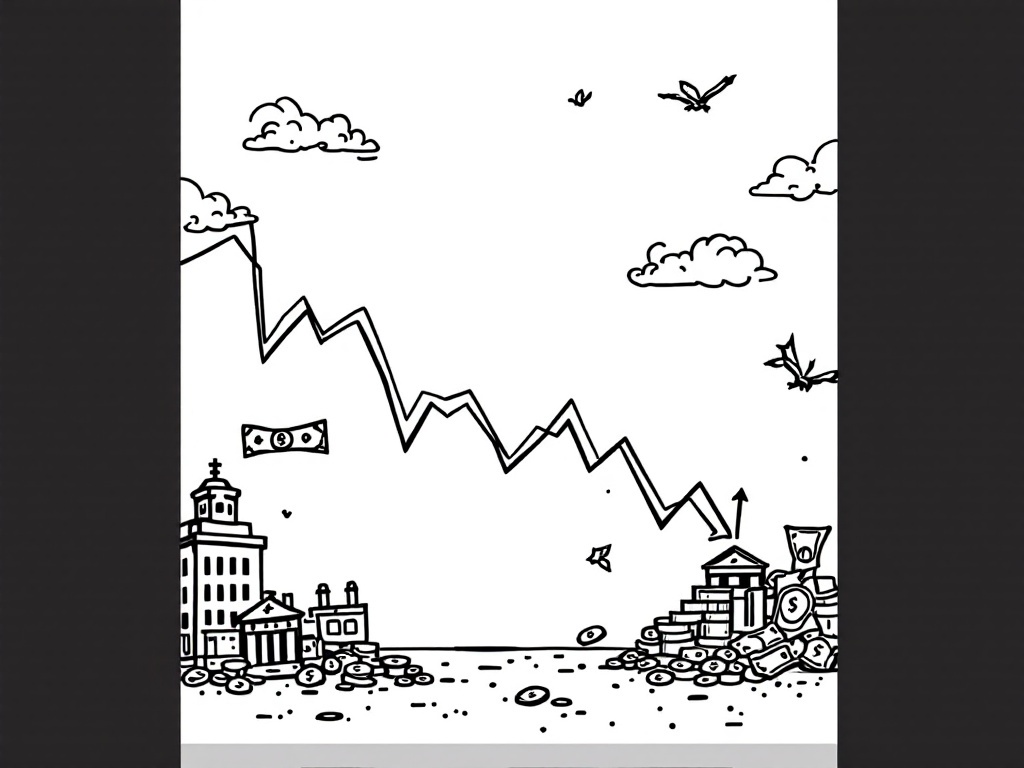

Block Shares Plummet 15% After Missing Q1 Expectations and Issuing Cautious Guidance

San Francisco, California, Thursday, 1 May 2025.

Block’s first-quarter revenue fell short of projections, leading to a 15% share price drop. Despite declaring a profitable quarter, the company issued conservative guidance reflecting ongoing economic challenges.

Block’s Q1 2025 Financial Miss and Market Reaction

Block, known by its ticker symbol SQ, experienced a significant 15% drop in share value following the release of its first-quarter 2025 financial results that did not meet Wall Street’s expectations. Analysts had predicted revenue of $6.2 billion, but Block reported $5.77 billion, marking a near 3% decline from the $5.96 billion recorded in Q1 of 2024. Despite this, Block’s gross profit increased by 9% to $2.29 billion, slightly below the anticipated $2.32 billion [1][2].

Guidance for the Coming Quarters

Reflecting on the current economic climate, Block has adopted a cautious financial outlook for the rest of 2025. The company projected Q2 gross profit to reach $2.45 billion, lower than the previously expected $2.54 billion. For the full year, Block’s gross profit guidance stands at $9.96 billion, under the analysts’ forecast of $10.2 billion. This conservative guidance comes amidst rising macroeconomic uncertainties affecting many sectors [1].

Market Perception and Analyst Opinions

The broader market reaction has been negative, as reflected in Block’s declining share price. However, the Chief Financial Officer, Amrita Ahuja, highlighted that despite the share price drop, Block delivered its most profitable quarter to date. The company’s operational discipline and efficient practices were underscored as key drivers of this profitability, hinting at a robust internal structure ready to weather external economic challenges. Analyst Bryan Keane noted that the headwinds encountered might represent the lowest point of gross payment volume growth for the year, suggesting potential improvement over time [1][2].

Square’s Prospects Amid Economic Uncertainty

Square, a subsidiary of Block, faces a challenging landscape shaped by economic uncertainties. Yet, according to analyst surveys, there remains a positive sentiment among U.S. small and medium-sized businesses regarding Square’s offerings. This suggests potential growth in merchant services adoption, which could buffer against broader economic challenges. Amidst these mixed signals, Block’s stock stands at a 61 out of 99 IBD Composite Rating, with optimism marked by some market analysts’ upgrades [2].