New Federal Reserve Long-Term Inflation Data Challenges Consumer Fears

St. Louis, Friday, 2 January 2026.

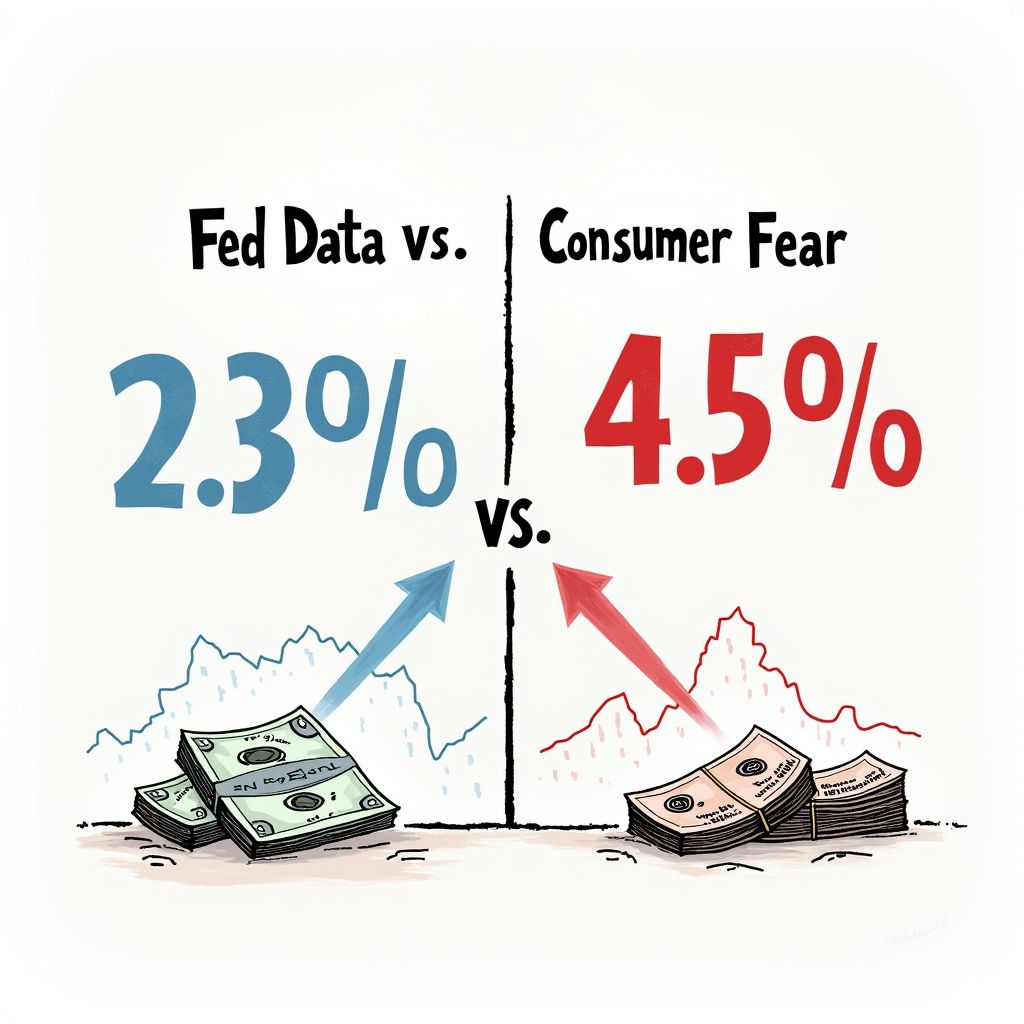

Updated Fed models predict stable 2.34% inflation over the next decade, sharply diverging from the 4.5% rate consumers expect, signaling a critical sentiment gap as 2026 trading begins.

A Divergence in Economic Reality

As the markets open for the first Friday of 2026, a stark contrast has emerged between institutional models and household sentiment regarding the future value of the dollar. While the Federal Reserve Bank of Cleveland’s latest modeling pegs the 10-year expected inflation rate at a manageable 2.34%, consumer expectations tell a different story, hovering significantly higher at 4.5% [1][2]. This discrepancy of 2.16 percentage points suggests that despite the central bank’s efforts to project stability, the average American remains wary of price persistence. This skepticism persists even though the Consumer Price Index (CPI) has averaged a more moderate 3.1% annually since 2016 [2]. Ideally, these figures would converge; the current gap indicates that the psychological impact of recent economic volatility has not yet abated.

Policy Shifts and Political Headwinds

The backdrop to this sentiment gap is the Federal Reserve’s contentious decision-making process at the close of 2025. Minutes from the Federal Open Market Committee (FOMC) meeting held on December 9-10, released just days ago, reveal a central bank in transition. The committee voted 9-3 to lower the federal funds rate by 0.25 percentage points, bringing the target range to 3.5%-3.75% [3]. This vote marked the highest number of dissents since 2019, underscoring the internal debate over whether inflation has been sufficiently tamed [3]. While officials acknowledged that President Trump’s tariffs were contributing to inflationary pressure, the consensus remained that these effects would be temporary and were expected to abate as 2026 progresses [3].

Yield Curve Dynamics and Investment Outlook

For investors navigating this landscape, the bond market offers mixed signals regarding risk and reward. As of the close of 2025, the 5-year Treasury note yielded 3.71%, while the 10-year note offered a higher yield of 4.17% [2][4]. This steepness in the yield curve suggests that markets demand higher compensation for locking up capital over the next decade, potentially reflecting those elevated consumer inflation expectations. Meanwhile, the effective federal funds rate stood at 3.88% at year-end, slightly above the yield on intermediate government debt, creating a nuanced environment for asset allocation [2]. With the Fed’s balance sheet standing at $6.6 trillion following a $2.3 trillion reduction, the central bank’s capacity to influence these long-term rates remains a pivotal factor for the fiscal year ahead [3].