Corn Storage Strategy Yields Profits in Bear Market

Chicago, Monday, 13 October 2025.

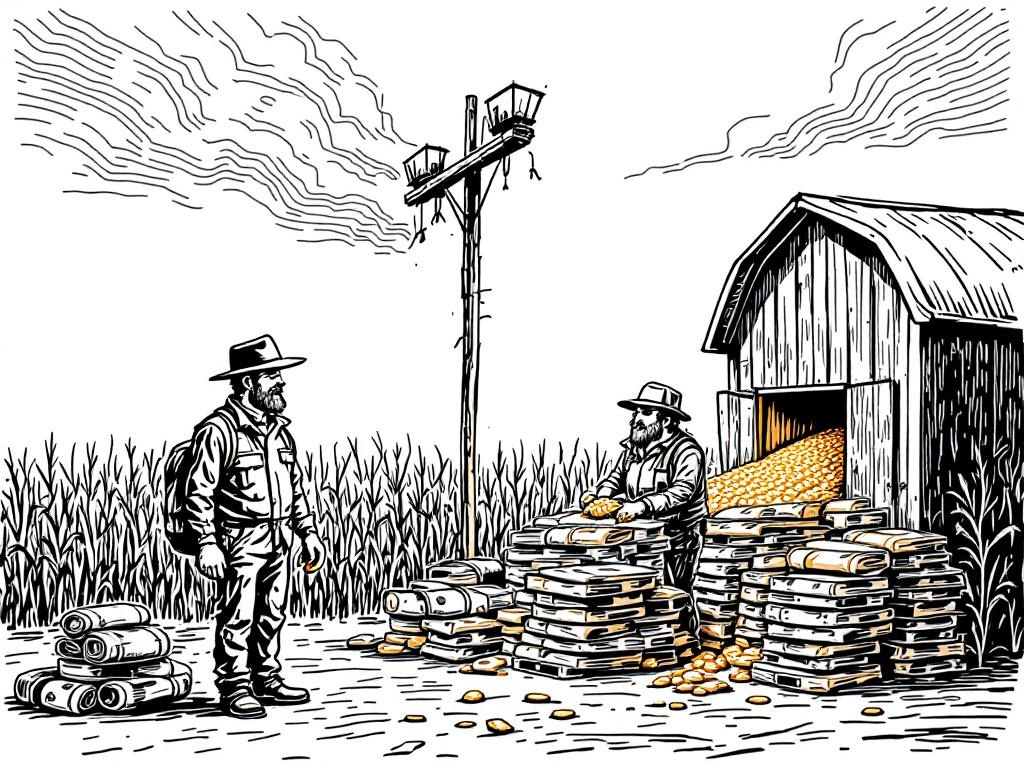

Amidst a bear market, corn producers leverage strategic storage hedging to capitalize on large carrying charges, enhancing profitability and reducing market risk exposure.

The Strategic Advantage of Corn Storage Hedging

In the current economic climate, characterized by a bear market impacting agriculture, corn producers are finding strategic storage hedging to be a profitable solution. This approach is gaining traction due to the large carrying charges that have returned to the corn markets. These charges, currently trading near 35 cents per bushel from December 2025 to July 2026, offer an opportunity to maximize profits by leveraging storage strategies [1].

Implementing the Four-Step Hedge Strategy

The four-step storage hedge strategy involves placing corn into on-farm storage, pricing the grain with deferred futures contracts, monitoring the basis, and unwinding the hedge when the basis narrows. This process is expected to yield a cash price close to $4.10 per bushel next spring, as the current futures sale price stands at $4.40 per bushel with an anticipated narrowing of the basis from 50 cents under to 30 cents under the July 2026 contract [1].

Market Dynamics and Expert Insights

Ed Usset, a marketing specialist at the University of Minnesota, emphasizes the conservative nature of this strategy. By focusing on selling the carry, farmers can improve their basis, though they may miss out on potential gains if a bull market emerges in 2026. Usset advises farmers to adapt and create new plans to take advantage of potential higher prices in the future, ensuring early and profitable sales for the 2026 crop [1].

Economic Implications and Future Considerations

This strategic approach not only mitigates risks associated with fluctuating market prices but also aligns with the broader economic conditions. The current bear market necessitates adaptive strategies for farmers, making storage hedging essential. This technique also underscores the importance of understanding market dynamics and being prepared to capitalize on future opportunities, especially in light of potential market shifts in 2026 [1].