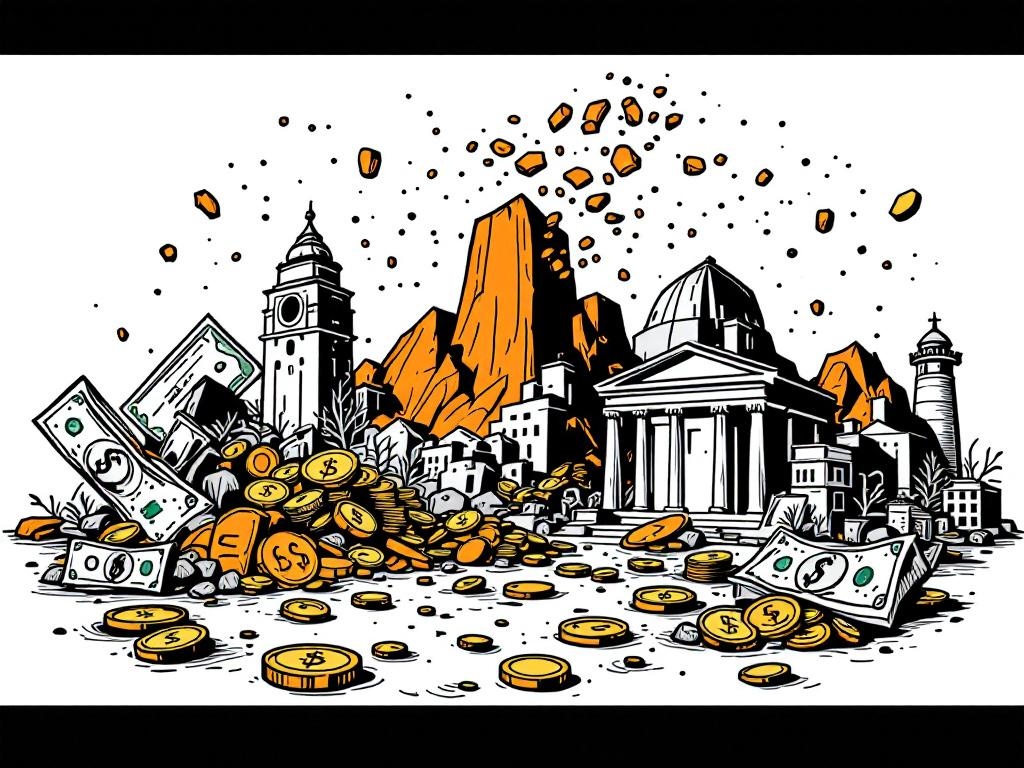

China's Mineral Monopoly Poses Major Risk to US Economy

Washington, D.C., Saturday, 7 June 2025.

China’s control over 80% of rare earth minerals is pressuring US industries, threatening economic stability as tensions suggest a new “Cold War” scenario.

Impact on US Technology and Automotive Industries

China’s control over 80% of the global supply of rare earth minerals, crucial for the technology and automotive industries, has left the US with a significant dependency on these imports. These minerals are indispensable for manufacturing smartphones, electric vehicles, and a wide range of other high-tech products, creating a strategic vulnerability in the US supply chain [1]. Reports suggest that global manufacturers are already experiencing disruptions, leading to potential production decreases as reliance on Chinese exports continues [2].

Economic Risks and Strategic Responses

The economic implications of this reliance are profound. Economists and industry experts warn of increased costs and supply chain vulnerabilities should China decide to restrict the export of these minerals to the US. The US government’s efforts to mitigate these risks include planned investments totaling $120 billion by 2027 to bolster domestic production capabilities for rare earth minerals, although these initiatives will take time to materialize and offset the current dependency [2][3].

Geopolitical Tensions and Trade Dynamics

The broader geopolitical landscape suggests a rekindling of ‘Cold War’-like tensions between the US and China. Divergent views from influential figures such as former Treasury Secretary Lawrence H. Summers and Hoover Institution’s Niall Ferguson underscore the complexities of the US-China relationship, described variably as ‘symbiotic but not symmetrical’ and ‘hostile codependence’ [4]. Amid these tension-filled dynamics, China’s control over critical resources is perceived as both an economic lever and a geopolitical tool that could be wielded against the United States [1].

Strategic Alternatives in International Trade

As the United States seeks to reduce its reliance on China, there is an ongoing initiative to develop alternative sources for rare earth minerals, including potential collaborations with allies. This move is part of a broader strategy to enhance the country’s global competitiveness while navigating the complex trade relationships and geopolitical tensions characterizing the current international landscape. The pursuit of such diversification is not only a defensive measure but a necessary strategic shift to secure economic stability and technological advancement [2][3].