Rising Jobless Claims and Tech Spending Concerns Weigh on US Markets

New York, Thursday, 5 February 2026.

Equities retreated as January job cuts hit a 2009 high and jobless claims rose to 231,000, while Alphabet’s aggressive spending plans dampened tech sentiment.

Market Sentiment Sours on Economic Data and Tech Outlook

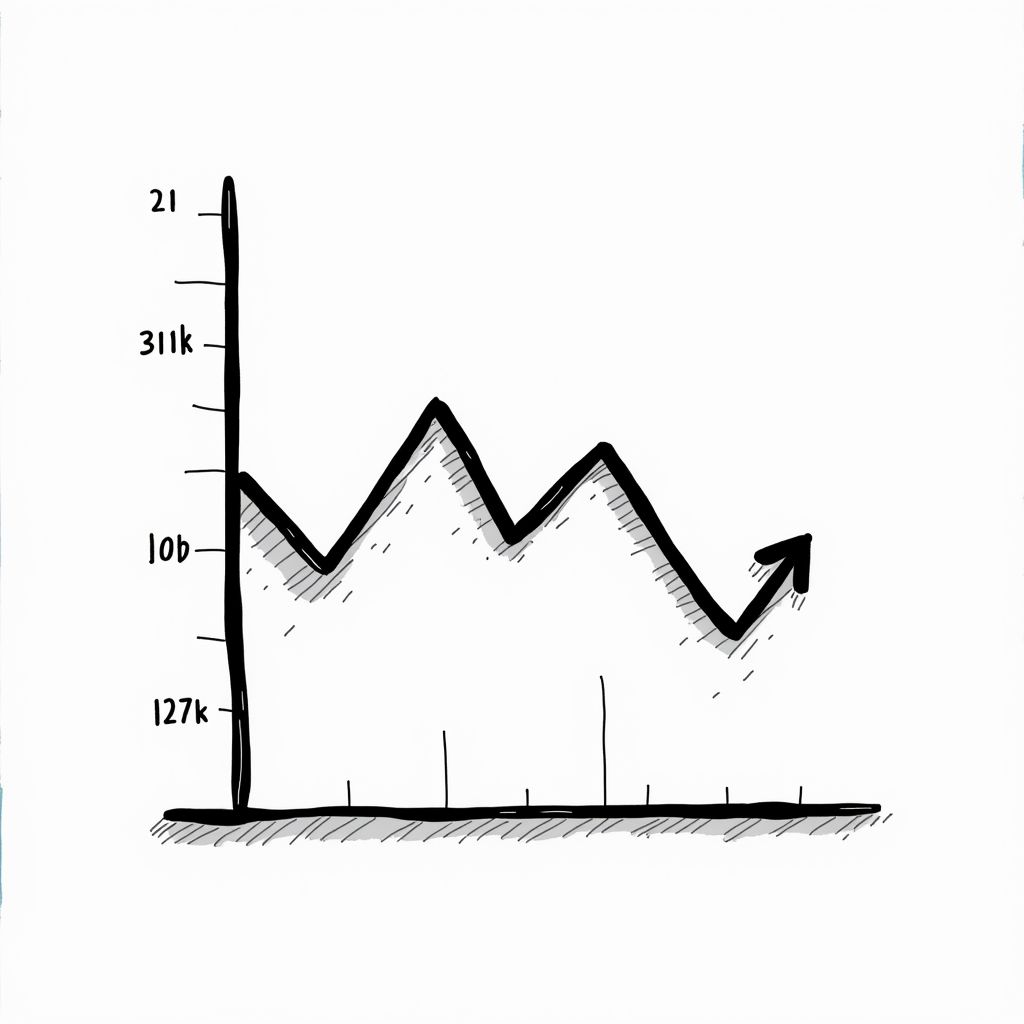

Wall Street faced a turbulent session on Thursday, February 5, 2026, as a confluence of discouraging labor data and anxieties surrounding big tech capital expenditures eroded investor confidence. The Dow Jones Industrial Average and Nasdaq Composite retreated as market participants digested a sharper-than-expected rise in unemployment filings alongside a massive spike in planned spending by Alphabet [1][4]. While major indexes attempted to trim losses by midday, the narrative has shifted toward scrutiny of the labor market’s durability and the immense costs associated with the artificial intelligence arms race [1]. The selling pressure was particularly acute in the technology sector, with the Nasdaq Composite down approximately 1,000 points, or 4.2%, over the last five trading days as of February 4 [4].

Labor Market Signals Stress

The most immediate catalyst for the market’s downturn was the release of weekly jobless claims data by the Labor Department, which indicated a potential softening in the U.S. economy [5]. Initial jobless claims for the week ending January 31 rose to 231,000, an increase of 22,000 from the previous week’s unrevised figure of 209,000 [3][6]. This print significantly exceeded the consensus forecast of 212,000 [5][6]. While economists at Pantheon Macro noted that claims are returning to trend after a period of unusually low seasonal hiring, the data exceeded all estimates in a Bloomberg survey [3][7]. It is worth noting that severe winter weather, which gripped much of the country during the reporting period, may have distorted the figures [3].

The Cost of AI Dominance

Beyond macroeconomic indicators, the technology sector is grappling with the financial realities of scaling artificial intelligence. Alphabet, Google’s parent company, saw its shares drop over 4% in premarket trading on February 4 and continued to face pressure on Thursday despite beating earnings expectations for the fourth quarter of 2025 [2][4]. The company reported earnings per share of $2.82 against an estimate of $2.63, with revenue reaching $113.83 billion [2]. However, investors were rattled by the company’s capital expenditure guidance for 2026, which is projected to land between $175 billion and $185 billion [2][4]. Analysts at Deutsche Bank described the spending plan as “stunning,” while Barclays noted that these costs weighed on the company’s overall profitability [2].

Summary

Thursday’s market movements underscore a pivotal moment for the U.S. economy as it enters the middle of the first quarter of 2026. The simultaneous release of data showing a 22,000 increase in jobless claims and the highest January job cuts in 17 years suggests the labor market may be more fragile than previously assumed [3][7]. When combined with the market’s negative reaction to Alphabet’s historic 180 billion average projected capital expenditure, investors are now forced to recalibrate their expectations for both economic growth and corporate profitability in the year ahead [2].

Sources

- www.investors.com

- www.ainvest.com

- www.bloomberg.com

- www.proactiveinvestors.com

- ca.investing.com

- www.fxstreet.com

- www.usatoday.com