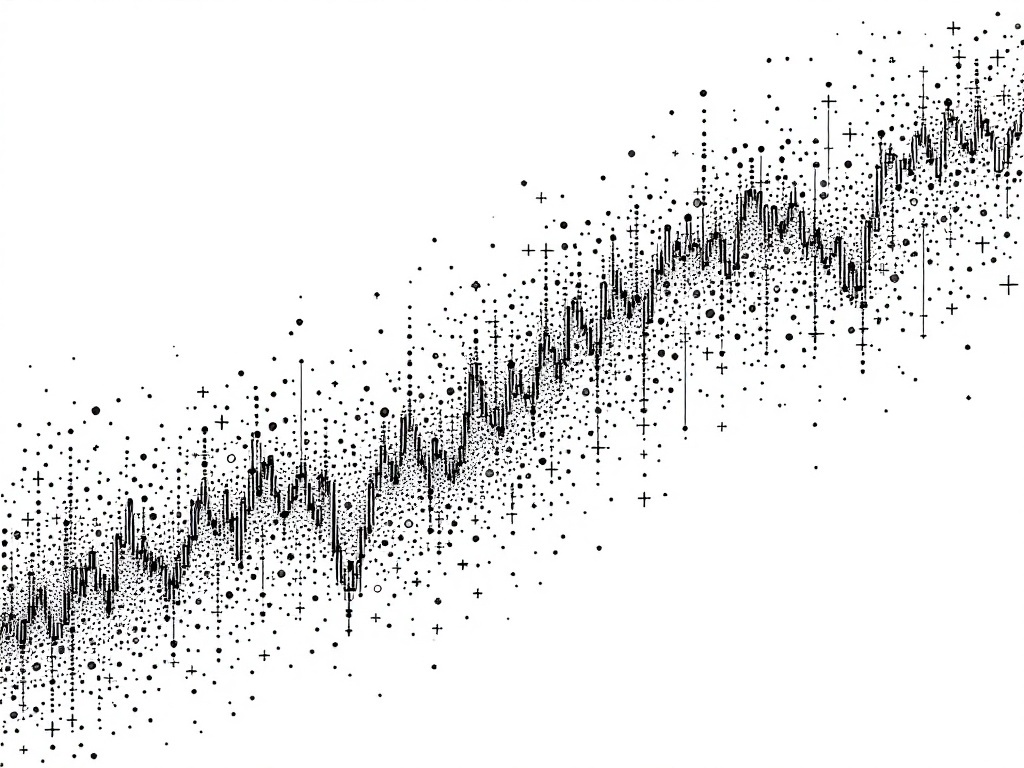

Nasdaq Faces Instability Amid Fluctuating AI Stocks

New York, Wednesday, 30 April 2025.

Despite leaving bear market territory, Nasdaq’s volatility continues due to AI stocks like Nvidia, Arista Networks, and Broadcom falling over 15%, raising concerns about tech sector confidence.

AI Stocks Drive Nasdaq Volatility

In the wake of the Nasdaq exiting bear market territory, the index continues to grapple with instability brought on by declining artificial intelligence (AI) stocks, including Nvidia (NVDA), Arista Networks (ANET), and Broadcom (AVGO). These stocks have experienced declines exceeding 15% as of late April 2025, prompting widespread concern about the resilience and confidence in tech investments amidst an evolving economic landscape [1][2].

Economic Factors Influencing Market Mood

Several geopolitical tensions, trade policies, and economic indicators are exacerbating Nasdaq’s volatility. Concerns about a potential U.S.-China trade war have significantly impacted investor sentiment, particularly affecting Nvidia, which has seen nearly a 20% drop in its stock value due to fears over AI spending and export restrictions on AI processors to China [3][4]. Moreover, overall market conditions reflect a broader uncertainty linked to economic policies and the anticipated impacts of tariffs on global trade [1][3][5].

Investor Reactions and Market Predictions

Despite historic growth in companies like Arista Networks, whose sales soared from $2.9 billion in 2021 to over $7 billion in 2024, stocks have nonetheless plummeted by nearly 30% this year. This sharp decline connects back to concerns about maintaining growth and profitability in a volatile AI sector [1][2]. Broadcom, after reaching a $1 trillion market capitalization earlier in 2025, similarly faces a downward trend, declining by 18% due to inflated valuation pressures [2][4].

Outlook for AI and Tech Investments

Looking forward, market analysts remain cautious about the tech sector’s trajectory amidst ongoing economic and geopolitical challenges. High valuations continue to place pressure on AI companies as the market anticipates future stabilization or potential resurgence depending on how companies address economic uncertainties and technological barriers. With Meta Platforms, Alphabet, and other tech giants ready to report earnings shortly, much of the Nasdaq’s short-term volatility will hinge on these announcements and their subsequent impact [3][4][5].