latest news in economy

Structural Integration Drives EV Fastener Market to $3.6 Billion Valuation

New York, Tuesday, 3 March 2026.

New analysis projects the global EV battery pack structural fasteners market will reach $3.6 billion by 2036, driven by an 8.9% CAGR. This expansion signals a critical pivot in automotive engineering: battery packs are transitioning from passive energy storage to active, load-bearing structural elements within ‘skateboard’ platforms. Consequently, demand is shifting toward high-strength alloy steel fasteners essential for crash integrity. With China and India leading production growth, manufacturers must adapt to these specialized, safety-critical requirements to capture value in the next generation of electric vehicle architectures.

Ontario Commitment of $104 Million Signals Major AI Shift for Industrial Sectors

Toronto, Tuesday, 3 March 2026.

Highlighting a pivotal shift at PDAC 2026, Ontario’s $104 million investment reveals that 85% of supported projects now leverage artificial intelligence to drive modernization in mining and manufacturing.

Kevin Warsh Nomination for Fed Chair Faces Senate Deadlock

Washington D.C., Tuesday, 3 March 2026.

Despite President Trump’s nomination, Kevin Warsh’s confirmation is stalled by a Republican senator citing an active DOJ investigation into Jerome Powell, casting doubt on the Federal Reserve’s upcoming leadership transition.

AI Search Algorithms Create Winner-Takes-All Dynamic by Isolating Single Law Firms

New York, Monday, 2 March 2026.

Q1 2026 testing reveals AI systems now narrow legal search results to one dominant firm, replacing traditional lists and forcing a “winner-takes-all” shift in client acquisition strategies.

Vanguard S&P 500 ETF Navigates Volatility Amid New Tariff Threats and AI Sector Shifts

New York, Monday, 2 March 2026.

Despite looming trade wars and rising geopolitical conflict, the Vanguard S&P 500 ETF attracted $2.68 billion in weekly inflows, as investors bet heavily on the resilience of AI market leaders.

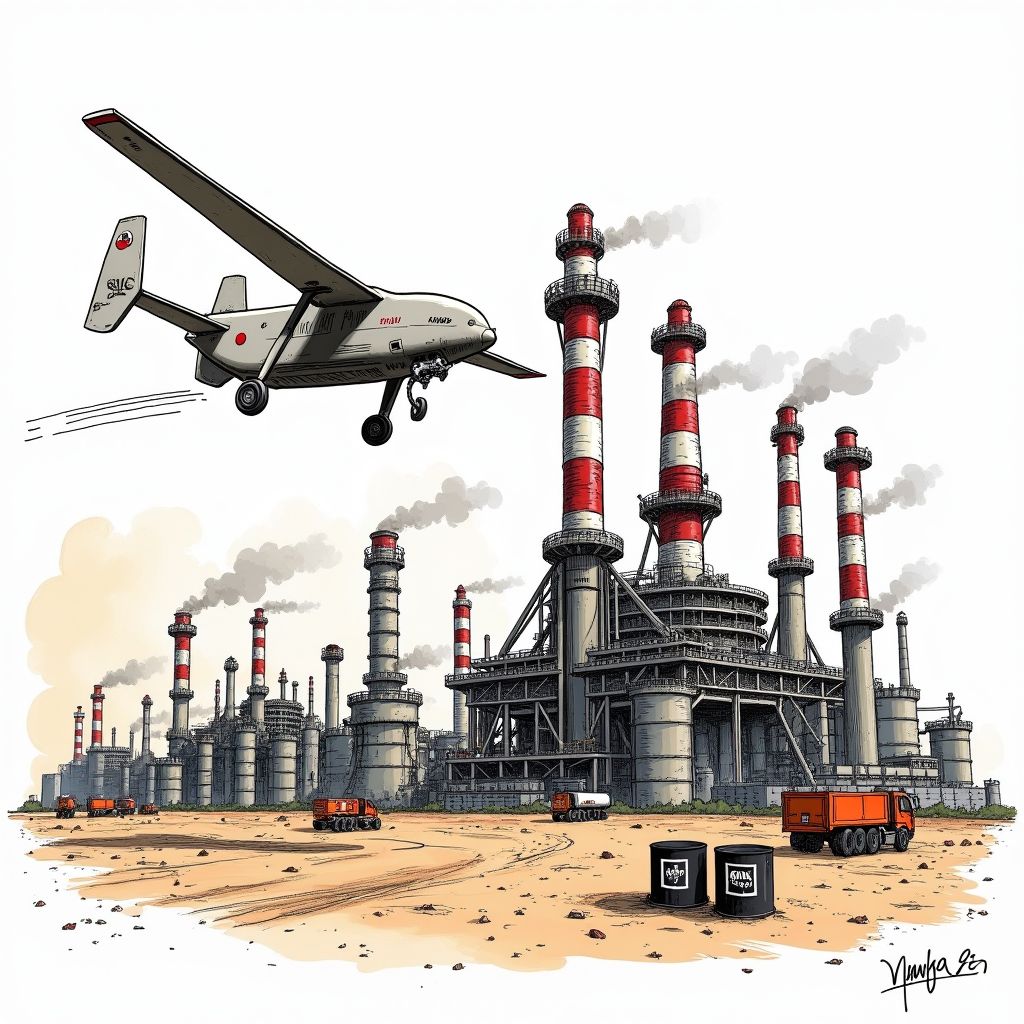

Saudi Aramco Suspends Major Refinery Operations After Drone Strike, Jolting Oil Markets

Ras Tanura, Monday, 2 March 2026.

Operations at the pivotal Ras Tanura refinery halted following a drone strike, driving Brent crude to $80 per barrel as the expanding Iran-Israel conflict threatens global energy supply lines.

Administration Links Future Rate Cuts to Projected AI Productivity Surge

Washington D.C., Monday, 2 March 2026.

The administration argues AI will mirror the 1990s internet boom to justify rate cuts, though economists warn the sector’s massive resource consumption could conversely spike near-term inflation.

Boston Real Estate Investment Pauses Amid Rent Control Concerns

Boston, Monday, 2 March 2026.

A major real estate investor is halting new Boston projects, managing $10 billion in assets. Citing policy uncertainties like rent control, they are diverting funds elsewhere, impacting Boston’s development.