EU Weighs €93 Billion Economic Countermeasure Against US Over Greenland Dispute

Brussels, Sunday, 25 January 2026.

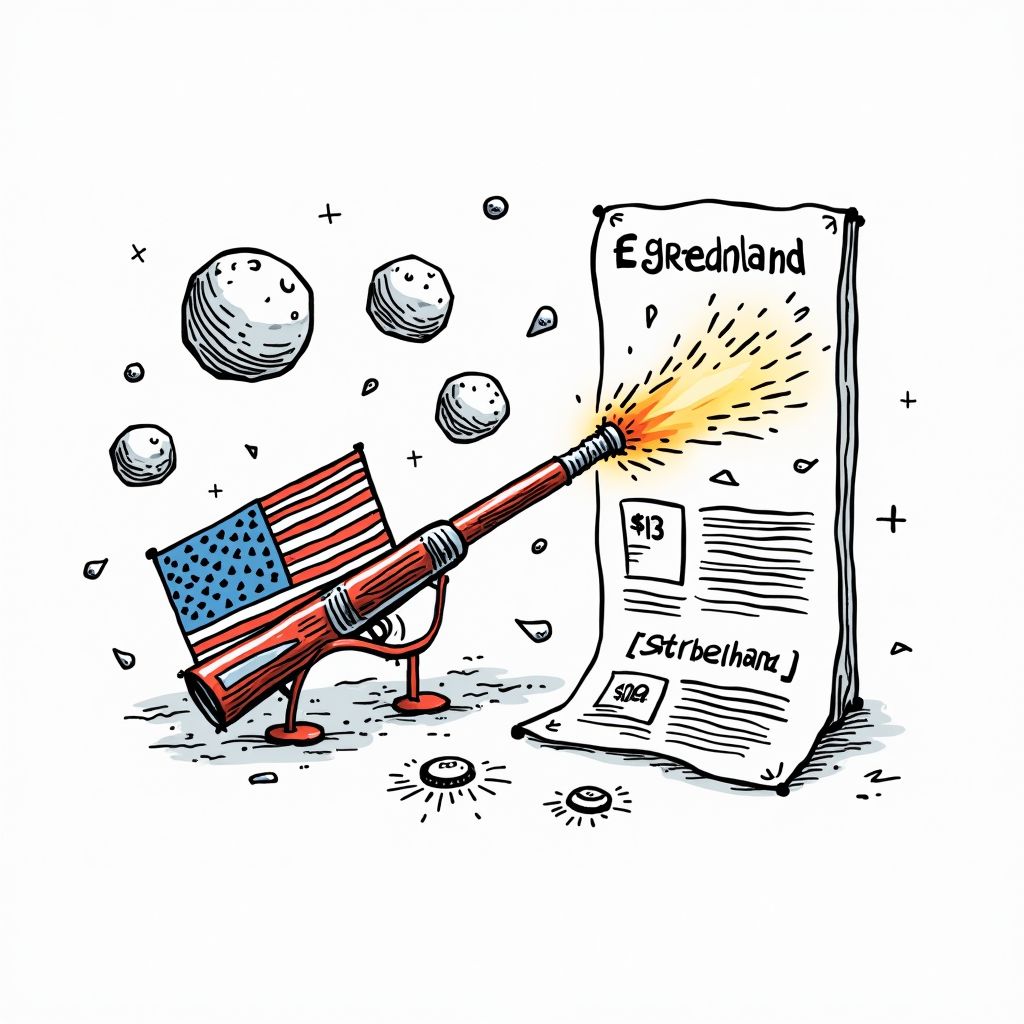

Brussels considers activating its “trade bazooka,” a €93 billion tariff package potentially targeting US tech giants, marking a severe escalation in transatlantic relations over the Greenland controversy.

From Rhetoric to Retaliation

While we previously analyzed how [geopolitics had begun to eclipse traditional economic indicators][1] regarding the Greenland standoff, the situation has rapidly materialized into a tangible financial threat with specific dollar figures attached. The European Union is now actively weighing a retaliatory package valued at approximately €93 billion ($108 billion) against the United States [2]. This massive economic counterstrike serves as a response to President Trump’s recent threats to impose a 10% tariff on goods from eight specific European nations—including Germany, France, and Denmark—as leverage in his bid to secure Greenland [3][4]. The activation of this package would utilize the EU’s Anti-Coercion Instrument (ACI), a mechanism colloquially dubbed the “trade bazooka,” which was designed specifically to deter foreign powers from bullying member states through economic pressure [3][4].

The Mechanics of the “Trade Bazooka”

The ACI allows Brussels to bypass the typically slow consensus-building process required for foreign policy decisions, offering a rapid response capability that includes tariffs, restrictions on intellectual property rights, and exclusion from public procurement markets [3][4]. The timeline for this escalation is tight; if no political agreement regarding Greenland’s status is reached, the U.S. tariffs are scheduled to more than double, rising from the initial 10% to 25% by June 2026 [4]. This represents a steep escalation of 150% in the tariff rate within a mere six-month window, creating a pressure cooker environment for transatlantic negotiators. European Commission President Ursula von der Leyen, speaking from Davos on January 20, warned that while Europe remains strategic, its response to such coercion would be “unflinching, united and proportional” [2].

Targeting the American Ledger

Brussels appears to be calculating its counter-strategy based on the specific vulnerabilities of the U.S. stock market, particularly the exposure of the so-called “Magnificent 7” technology giants. These seven companies currently comprise 34% of the S&P 500’s total value, making the broader index highly sensitive to their performance [5]. The EU’s leverage lies in the heavy reliance of these firms on non-U.S. revenue streams; for instance, Meta derives 62% of its revenue from outside the U.S., while Apple and Nvidia rely on international markets for 57% and 53% of their revenue, respectively [5]. By utilizing the ACI to target digital services or intellectual property rights, the EU could threaten the share prices of these widely held stocks, thereby impacting the financial security of the 60% of American families invested in the market [5]. Furthermore, the EU is considering using its Digital Markets Act to levy fines on U.S. tech companies, capitalizing on the fact that U.S. providers hold approximately 70% of the European cloud service market [2].

Capital Flight and Strategic Autonomy

Beyond tariffs, the first signs of financial decoupling have already emerged. On January 20, 2026, the Danish pension fund AkademikerPension announced the sale of $100 million in U.S. Treasuries, a symbolic yet significant move signaling that European institutional investors may begin reducing their exposure to U.S. debt [2]. With Europeans holding approximately $8 trillion in U.S. bonds and equities, a coordinated shift in investment strategy could have profound implications for U.S. liquidity [2]. While President Trump backed off immediate threats of military force at Davos, stating he would not impose new tariffs “for now,” the uncertainty has accelerated the EU’s push for “strategic autonomy,” driving member states to reduce asymmetric dependencies on U.S. security and energy [6]. The dispute has effectively transformed from a territorial disagreement into a systemic stress test for the Western financial alliance.