Citigroup Forecasts Limited US-Israel Military Actions to Avert Regional War

New York, Friday, 30 January 2026.

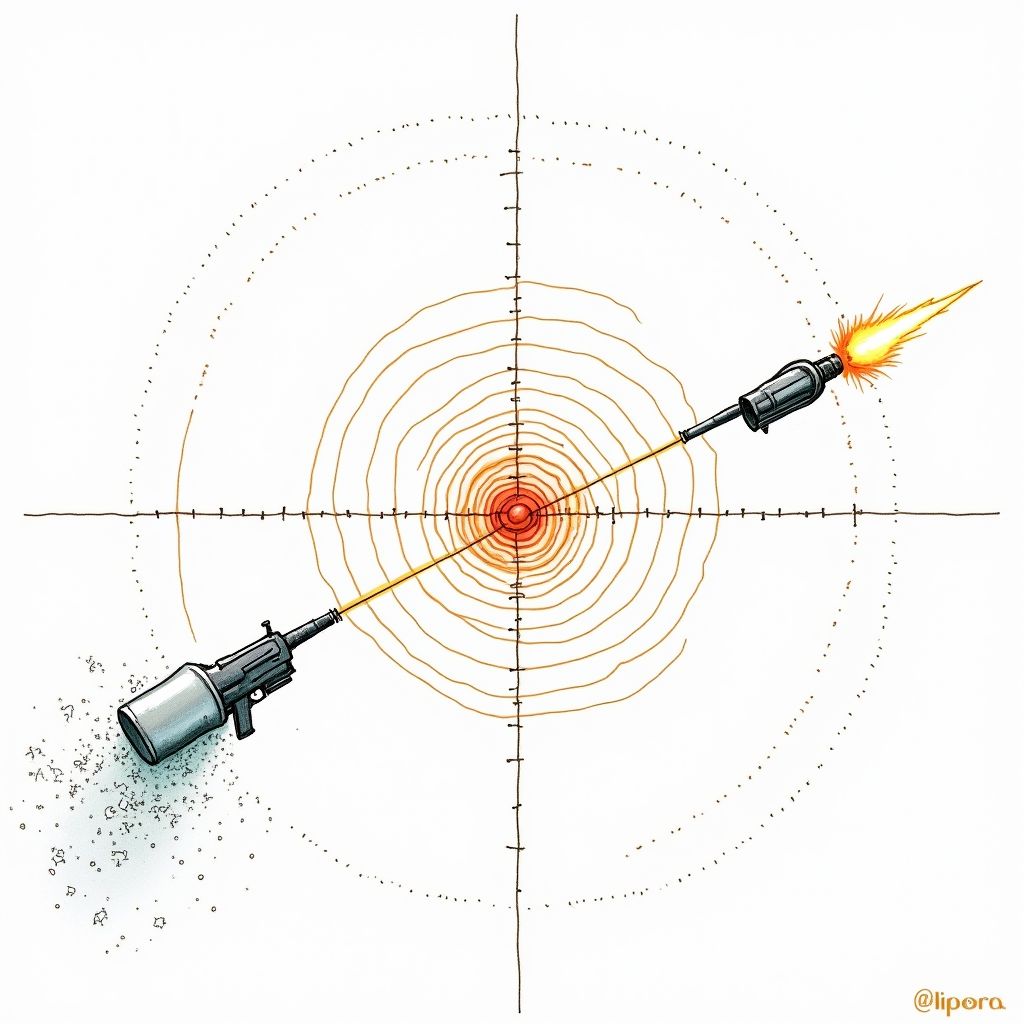

Analysts assign a 70% probability to restricted engagement, predicting targeted strikes and tanker seizures will be used to force a nuclear deal while avoiding full-scale regional war.

Strategic Restraint amid Rising Tensions

In a research note released on Thursday, January 29, Citigroup analysts outlined a “base case” scenario in which the United States and Israel pursue restricted military operations against Iran rather than a full-scale offensive [1]. The bank assigns a 70% probability to this outcome, predicting that actions will likely be limited to targeted strikes and oil tanker seizures intended to pressure Tehran into a new nuclear agreement [1][3]. This analysis suggests that despite the aggressive rhetoric, the administration of U.S. President Donald Trump aims to avoid an escalatory response that could trigger a broader regional war, largely due to domestic sensitivity regarding high energy prices [1]. Furthermore, Citigroup notes that Iran is unlikely to seek a major conflict, given that the nation is currently grappling with a faltering economy and significant civil unrest [3].

Market Implications and Oil Price Volatility

The prospect of military engagement has already impacted global markets, with oil prices climbing to a five-month high on Thursday [8]. Brent crude futures settled at $70.71 a barrel on January 29, reflecting the market’s anxiety over potential supply disruptions [1]. Citigroup estimates that the geopolitical risk premium currently embedded in oil prices ranges between $7 and $10 per barrel [1]. While the bank’s base case envisions a de-escalation and a potential U.S.-Iran deal later in 2026, analysts warn that immediate tensions could keep prices elevated [1]. In a bullish scenario where geopolitical risks escalate further over the next three months, Citigroup projects that prices could reach $72 per barrel [5][7].

Inventory Data and Economic Context

Beyond geopolitical friction, fundamental market data is also supporting price floors. On Wednesday, the U.S. Energy Information Administration reported a decline in U.S. crude inventories of 2.3 million barrels for the week ending January 23, defying analyst expectations of a 1.8 million-barrel increase [5][7]. This tightening of supply comes as the Federal Reserve chose to hold interest rates steady on Wednesday, citing a healthy U.S. economy [5]. The combination of unexpected inventory drawdowns and stable monetary policy has reinforced the resilience of oil prices, even as traders navigate the uncertainties of Middle Eastern stability [5].

Alternative Risk Scenarios

While a contained conflict remains the primary forecast, Citigroup has modeled less favorable outcomes. The bank identifies a 30% probability of heightened but still limited conflict, where internal political instability in Iran causes intermittent disruptions to oil production and exports [1][3]. More alarmingly, there remains a 10% tail risk of substantial regional supply losses driven by widespread civil unrest and direct conflict involving the U.S. and Israel [1]. Should the base case of de-escalation materialize in 2026, however, the current geopolitical risk premium is expected to dissipate, stabilizing energy markets [1].

Sources

- www.reuters.com

- www.marketscreener.com

- www.devdiscourse.com

- www.reuters.com

- whtc.com

- energynow.com

- www.businessday.co.za

- srnnews.com