NASDAQ Composite Slides Nearly 2.5% in Significant Intraday Sell-Off

New York, Friday, 19 December 2025.

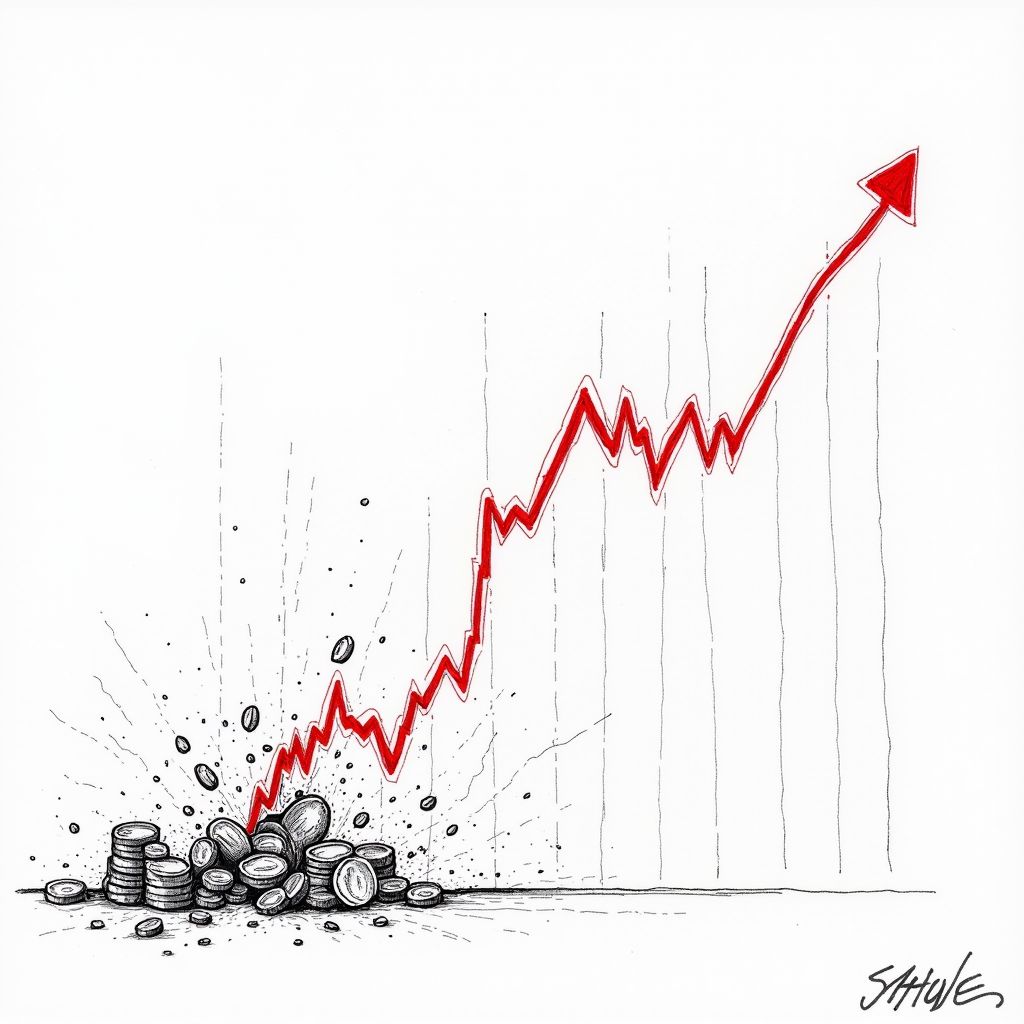

On December 19, 2025, the NASDAQ Composite plunged approximately 2.49% to intraday lows of 22,906. This sharp retreat from the 23,000 level signals shifting investor sentiment regarding technology valuations, significantly widening the gap from the index’s October highs.

Reversal of Fortunes

The sharp decline on Friday, December 19, represents a swift negation of the optimism seen just twenty-four hours earlier. On December 18, the NASDAQ Composite had managed to close at 23,006.36, registering a gain of roughly 1.38% and seemingly snapping a four-day losing streak [2][3]. However, the index’s inability to hold the 23,000 threshold suggests that the selling pressure remains dominant. The retreat to intraday lows of approximately 22,906 [1] essentially retests the floor established during the previous session, where the day’s low was recorded at 22,906.233 [2]. This technical failure to build upon Thursday’s recovery indicates that the market’s “risk-off” sentiment has not yet dissipated.

Widening Gap from Highs

This downward trajectory places the technology-heavy index in a precarious position relative to its recent peaks. The NASDAQ is now trading significantly below its 52-week high of 24,019.99, which was established on October 29, 2025 [2]. The current intraday low represents a drawdown of approximately 4.638% from that October peak. While the index maintains a substantial buffer above its 52-week low of 14,784.03 set in April [2], the widening divergence from the 24,000 level signals a reassessment of valuations among major technology constituents.

Volatility Resurfaces

The session’s volatility underscores the fragile nature of the current market environment. Although major stock indexes had flipped positive and closed higher on Thursday [3], the immediate resumption of selling on Friday points to underlying instability. Market observers note that despite the Dow and S&P 500 recently ending their own losing streaks [3], the NASDAQ’s 2.49% slide [1] reveals that investors are still aggressively reining in risk, particularly in high-growth sectors.