TC Energy Shareholders Face January Deadline to Lock in Fixed or Floating Dividend Rates

Calgary, Wednesday, 31 December 2025.

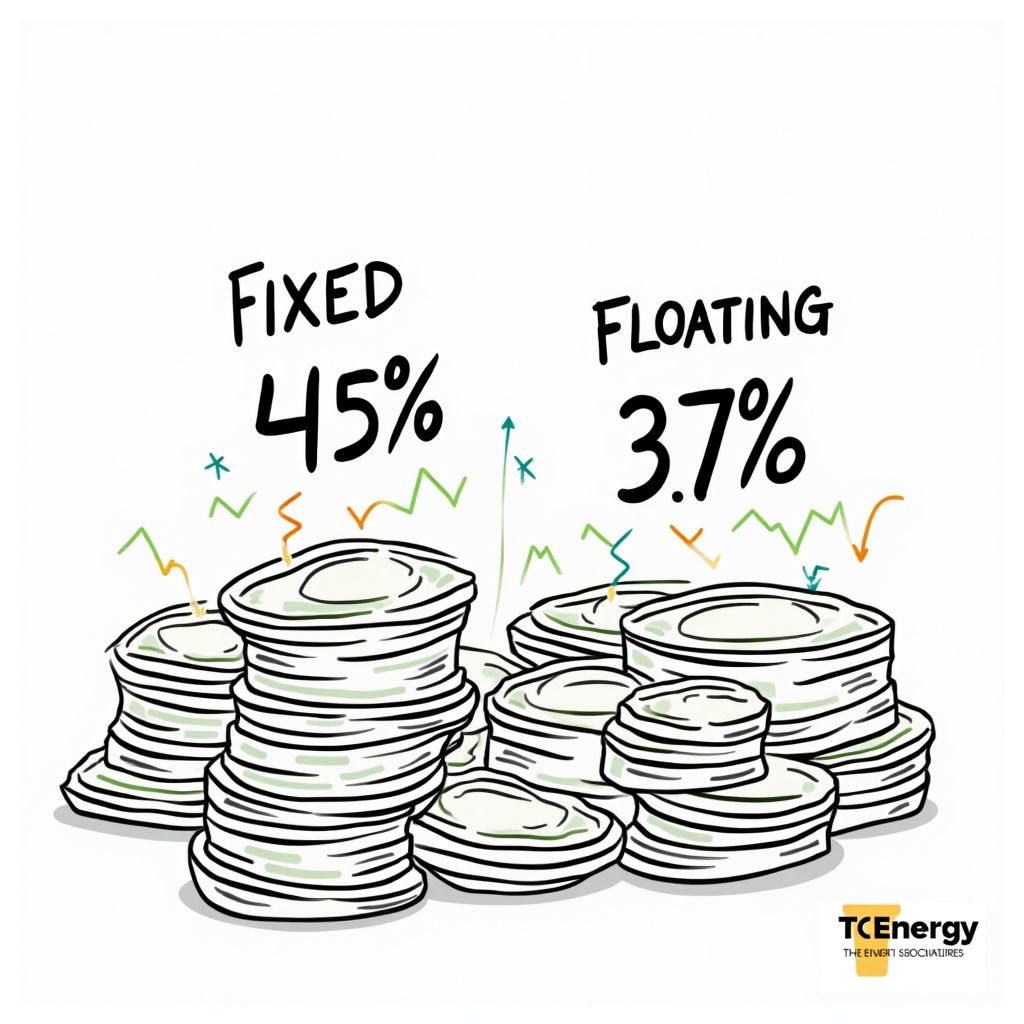

Shareholders must decide by January 16 whether to secure a 4.501% fixed annual rate or opt for a floating dividend, currently set lower at 3.732%.

New Rates and Deadlines for Preferred Shareholders

TC Energy Corporation (TSX:TRP) announced on Wednesday, December 31, 2025, that it will not redeem its Series 5 and Series 6 Cumulative Redeemable First Preferred Shares on the upcoming January 30, 2026, conversion date [1]. Instead, the Calgary-based energy infrastructure giant has established the new dividend rates that will apply for the next five years and the coming quarter, respectively [1]. Beneficial owners of these securities must communicate with their brokers by 5 p.m. ET on January 16, 2026, to exercise their conversion rights [1]. This decision point requires investors to actively evaluate their interest rate outlooks against the specific terms offered by the corporation.

Analyzing the Yield Differential

For holders of Series 5 shares, the new fixed annual dividend rate will be 4.501%, effective from January 30, 2026, through January 30, 2031 [1]. Investors can choose to retain these shares or convert them into Series 6 shares, which will accrue dividends at a floating rate [1]. Conversely, Series 6 shareholders can retain their floating-rate exposure or convert to Series 5 shares to lock in the fixed rate [1]. The floating quarterly dividend rate for Series 6 shares has been set at 3.732% for the initial period spanning January 30, 2026, to April 30, 2026 [1]. This creates an immediate yield difference of 0.769 percentage points in favor of the fixed option for the first quarter. While the fixed rate provides certainty for five years, the floating rate resets quarterly, offering potential upside if interest rates rise but carrying a lower initial yield [1].

Operational Context and Future Growth

This preferred share reset occurs as TC Energy continues to adapt its financial structure following the October 1, 2024, spinoff of its liquid pipelines business into South Bow Corp [3]. The company, which moves over 30% of the natural gas consumed daily across North America, now derives approximately 90% of its earnings from natural gas pipelines [2][3]. Common shares of TC Energy currently offer a dividend yield of approximately 4.4% to 4.5%, with the company targeting annual dividend growth of 3% to 5% supported by its regulated assets and long-term contracts [3][4][5]. The company’s resilience is underpinned by a massive 93,600-kilometer network of natural gas pipelines across Canada, the U.S., and Mexico [2].

Capital Projects Driving Future Value

Looking ahead, TC Energy is executing a robust capital program to sustain its financial commitments. The company targeted $8.5 billion in new projects for 2025 and plans to invest a total of $28 billion in infrastructure upgrades and new developments through 2030 [3]. A critical near-term asset is the $3.8 billion Southeast Gateway pipeline in Mexico, a 715-kilometer offshore project expected to commence operations later in 2025 [3]. As the January 16 deadline approaches, shareholders must weigh these long-term growth prospects and the stability of the 4.501% fixed rate against the flexibility of the floating rate option [1].