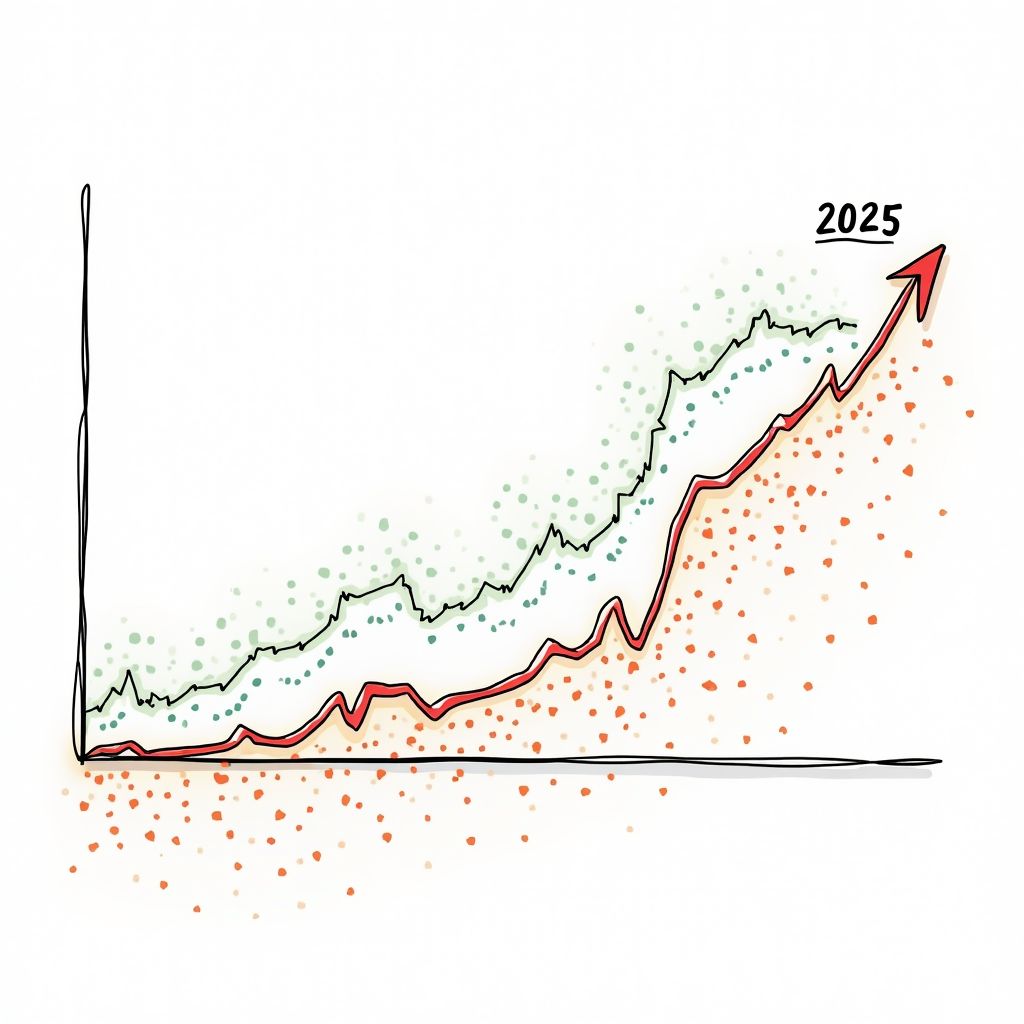

December Jobs Data Confirms 2025 as Weakest Hiring Year Since 2020

Washington, Friday, 9 January 2026.

Adding just 50,000 jobs in December, the U.S. concludes its weakest hiring year since the pandemic. Annual gains plummeted to 584,000, a stark contrast to the 2 million added in 2024.

A Decidedly Mixed Report

The Department of Labor’s release on Friday, January 9, 2026, revealed that the U.S. economy added 50,000 nonfarm payrolls in December 2025, falling short of the 73,000 forecast by Dow Jones economists [2] and the 60,000 projected by LSEG [4]. While the headline number remains positive, substantial downward revisions to prior months paint a more concerning picture of the labor market’s trajectory. The Bureau of Labor Statistics (BLS) deepened its estimate of October’s job losses to 173,000—significantly worse than the initially reported loss of 105,000—and trimmed November’s gains from 64,000 to 56,000 [1][4]. The unemployment rate edged down to 4.4%, defying expectations of 4.5%, though this occurred alongside a decline in the labor force participation rate to 62.4% [2][4].

Sector Divergence: Services Sustain While Goods Struggle

December’s hiring activity highlighted a sharp bifurcation in the economy, with gains concentrated heavily in service-oriented sectors. Food services and drinking places led the expansion, adding 27,000 roles, while the healthcare sector contributed another 21,000 jobs [4]. Social assistance also saw growth, adding 17,000 positions [2]. Conversely, cyclical and consumer-dependent sectors faced headwinds; retail trade shed 25,000 jobs, and the manufacturing sector lost 8,000 positions, exceeding the estimated loss of 5,000 [4]. This uneven growth reinforces the narrative of a “K-shaped” economic environment where specific industries continue to thrive while others contract [5].

2025: The Year of the “Hiring Recession”

The December data caps a year defined by a dramatic deceleration in hiring velocity. Throughout 2025, the U.S. economy added a total of 584,000 jobs, a -70.8% decline compared to the more than 2 million jobs created in 2024 [1][5]. Monthly payroll gains averaged just 49,000 in 2025, a steep drop from the 168,000 monthly average seen the previous year [2]. Heather Long, chief economist at Navy Federal Credit Union, characterized the period as a “hiring recession,” noting that while economic growth remains strong, it has ceased to translate into broad-based employment opportunities [2]. This slowdown was partly driven by fiscal and regulatory shifts, including a decrease in government employment linked to the elimination of federal positions under the new Department of Government Efficiency and tighter immigration restrictions introduced by the Trump administration [1].

Monetary Policy and the Path Forward

The Federal Reserve, having already cut interest rates at three consecutive meetings starting in September 2025, now faces a labor market that appears to be cooling faster than inflation is falling [7]. The benchmark interest rate currently sits between 3.5% and 3.75% [4]. Despite the soft jobs data, market expectations suggest the central bank will pause its easing cycle; the CME FedWatch tool indicates a 97.2% probability that rates will remain unchanged at the Fed’s meeting later this month [4]. This caution is likely driven by the fact that while hiring has slowed, the unemployment rate of 4.4% remains historically low, and average hourly earnings rose 3.8% year-over-year in December, suggesting wage pressures persist [1][2].

Sources

- www.nbcnews.com

- www.cnbc.com

- www.cnbc.com

- www.foxbusiness.com

- www.businessinsider.com

- www.youtube.com

- abcnews.go.com

- www.advisorperspectives.com