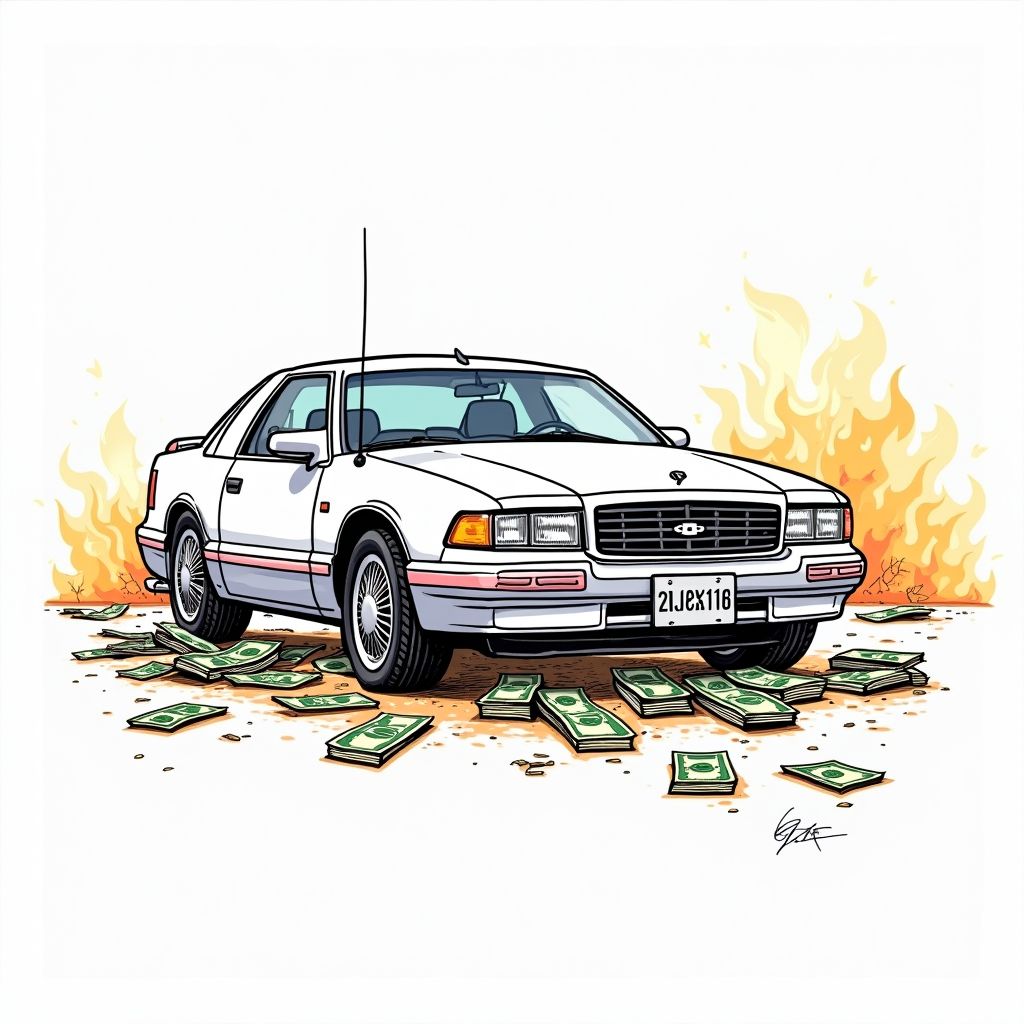

Gotham City Research Challenges Carvana's Financials Alleging $1 Billion Earnings Overstatement

Tempe, Wednesday, 28 January 2026.

Gotham City Research alleges Carvana overstated earnings by over $1 billion, claiming the retailer’s apparent profitability relies on undisclosed, debt-fueled subsidies from entities controlled by the CEO’s family.

Allegations of Accounting Irregularities

On Wednesday, January 28, 2026, shares of Carvana (CVNA) experienced significant volatility, declining between 9% and over 16% following the release of a critical report by short-selling firm Gotham City Research [1][3][4]. The firm alleges that Carvana’s earnings for the 2023-2024 period are overstated by more than $1 billion, a figure that starkly contrasts with the company’s reported total earnings of just over $550 million for those two years [1][3]. Gotham City Research contends that the automotive retailer is “far more dependent” on related-party transactions than it has disclosed to investors, specifically highlighting a complex financial interplay with entities controlled by Ernie Garcia II, the father of Carvana’s CEO [1][2]. As of the report’s release, Carvana has not yet responded to these allegations [1].

The Related-Party Ecosystem

A central component of Gotham City’s thesis involves DriveTime, a company also controlled by the Garcia family. The report claims that DriveTime burned over $1 billion in cash flow from operating activities throughout 2023 and 2024 while simultaneously accumulating significant debt [1][2]. Consequently, Gotham estimates that DriveTime’s leverage now sits between 20 and 40 times earnings, a dramatic increase from historical levels which were capped at 10.3 times prior to 2023 [1][2]. The short seller argues that this leverage effectively fuels Carvana’s Adjusted EBITDA; without the credit support from DriveTime, Gotham asserts that Carvana’s earnings would collapse and fail to cover its interest expenses [2].

Analyst Optimism Meets Short-Seller Skepticism

This bearish report clashes sharply with recent optimism from institutional analysts. Just days prior, on January 26, 2026, Wells Fargo raised its price target for Carvana to $525, maintaining an ‘Overweight’ rating, while JPMorgan increased its target to $510 in anticipation of a strong fourth-quarter performance [4]. Despite this institutional support, retail sentiment on platforms like Stocktwits shifted to “extremely bearish” following the news [4]. Looking ahead, Gotham City Research predicts severe corporate governance consequences, including a delay in Carvana’s 2025 10-K filing, the restatement of financials for 2023 and 2024, and the eventual resignation of Grant Thornton as the company’s auditor [1][2].