US Secures Transfer of 50 Million Barrels of Venezuelan Crude Following Military Operation

Washington D.C., Wednesday, 7 January 2026.

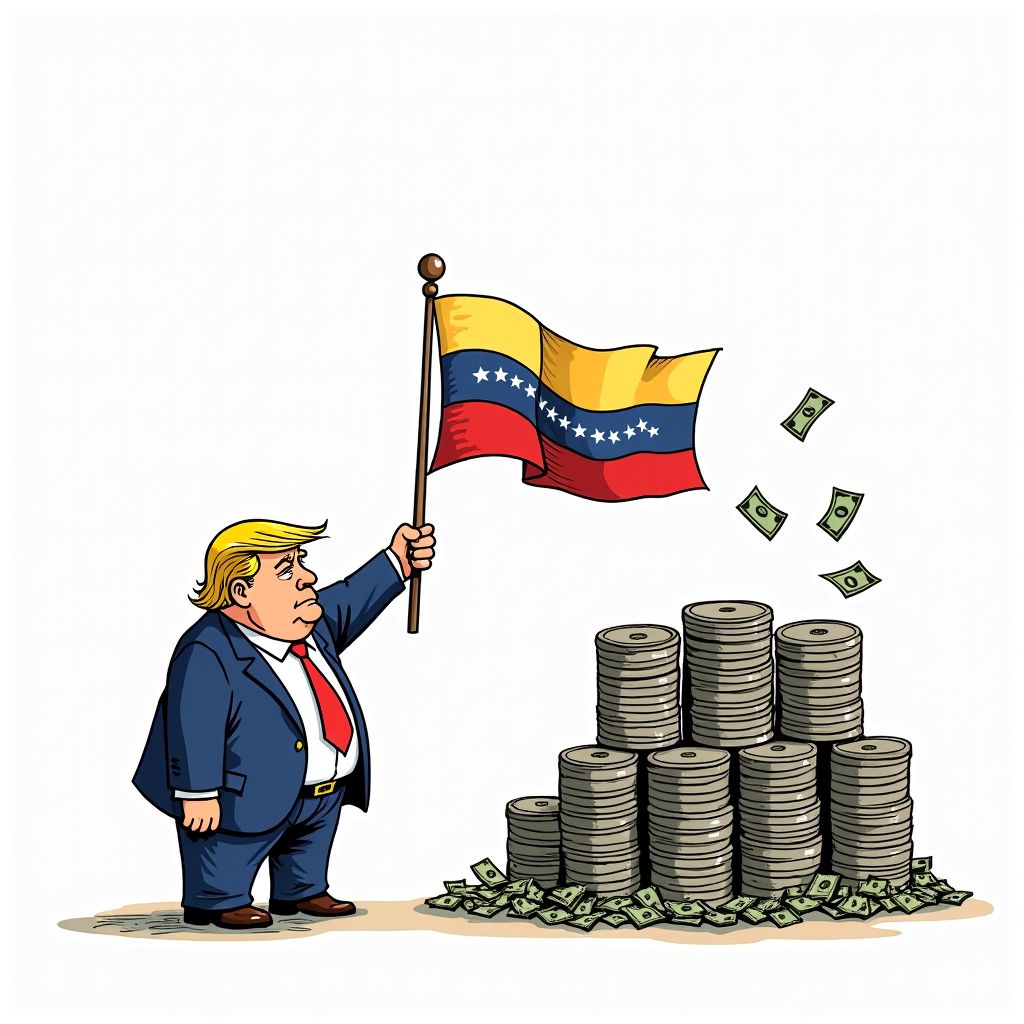

President Trump asserts direct control over proceeds from 50 million barrels of Venezuelan crude transferring to the US, a strategic move following the recent military ousting of Maduro.

Strategic Resource Acquisition

Following earlier reports that [global markets rallied on plans to revitalize Venezuela’s energy sector][9], the scope of US intervention has materialized into immediate resource transfer. On Tuesday, January 6, 2026, President Donald Trump formally announced that Venezuela will turn over between 30 million and 50 million barrels of crude oil to the United States [1][2]. This directive comes just days after US military forces captured Venezuelan President Nicolás Maduro in a raid on Saturday, January 3, 2026 [3][4]. While the previous administration’s sanctions isolated the country’s output, this development marks the active extraction of assets under new geopolitical terms.

Logistics and Administrative Oversight

The logistics of this massive transfer are already taking shape under the guidance of US Energy Secretary Chris Wright, whom the President has requested to assist in the operation [3][4]. The plan dictates that the oil will be loaded onto storage ships and transported directly to unloading docks within the United States [3][4]. While the administration claims the sale of this oil at market prices will benefit the populations of both nations, President Trump explicitly stated that the revenue generated “will be controlled by me, as President of the United States” [2][3]. This centralization of financial control is being facilitated by what the President termed “Interim Authorities” in Venezuela [4], following the swearing-in of Delcy Rodríguez as the country’s interim president on January 4 [3].

Direct Control and Economic Implications

This move signals a distinct shift in US foreign policy regarding seized assets. Distinguishing this operation from the Iraq War, President Trump remarked on Monday that his administration intends to “keep the oil” this time, asserting that previous administrations erred by not retaining resources in similar conflicts [4]. Stephen Miller, the deputy chief of staff, emphasized the totality of US control, stating on January 6 that Venezuela is under a “complete embargo” and requires American permission to conduct commerce [6]. This level of oversight effectively places the decision-making power for Venezuela’s primary export—and its economic lifeline—solely within the White House [6].

Market Impact and Supply Chain Challenges

The economic ramifications of reintegrating Venezuelan supply are substantial. Venezuela holds the world’s largest proven oil reserves yet currently contributes less than 1% to global supply due to decades of infrastructure decay [5]. As of November 2025, production hovered around 820,000 barrels per day [7]. With Brent crude trading near $61 per barrel, analysts warn that a sudden influx of supply could depress prices further, potentially pushing them toward $50 per barrel [7]. While the administration projects a timeline of less than 18 months to revive production [3], experts suggest a full recovery of the sector could require $100 billion in investment over a decade [5].

Operational Costs and Human Toll

The immediate transfer of assets follows significant violence during the initial military operation. The January 3 raid resulted in the deaths of at least 24 Venezuelan security officers and 32 Cuban military and police personnel [1]. Additionally, seven US service members were injured during the operation, with five having since returned to duty [1]. As the White House prepares to meet with oil executives this week to discuss further infrastructure development [1], the transfer of these 50 million barrels represents the first tangible economic output of the intervention.

Sources

- apnews.com

- www.reuters.com

- www.usatoday.com

- thehill.com

- www.pbs.org

- www.cbc.ca

- www.nytimes.com

- www.barrons.com

- wsnext.com