S&P 500 Secures 17% Annual Gain as Market Adapts to Tariff Volatility

New York, Thursday, 1 January 2026.

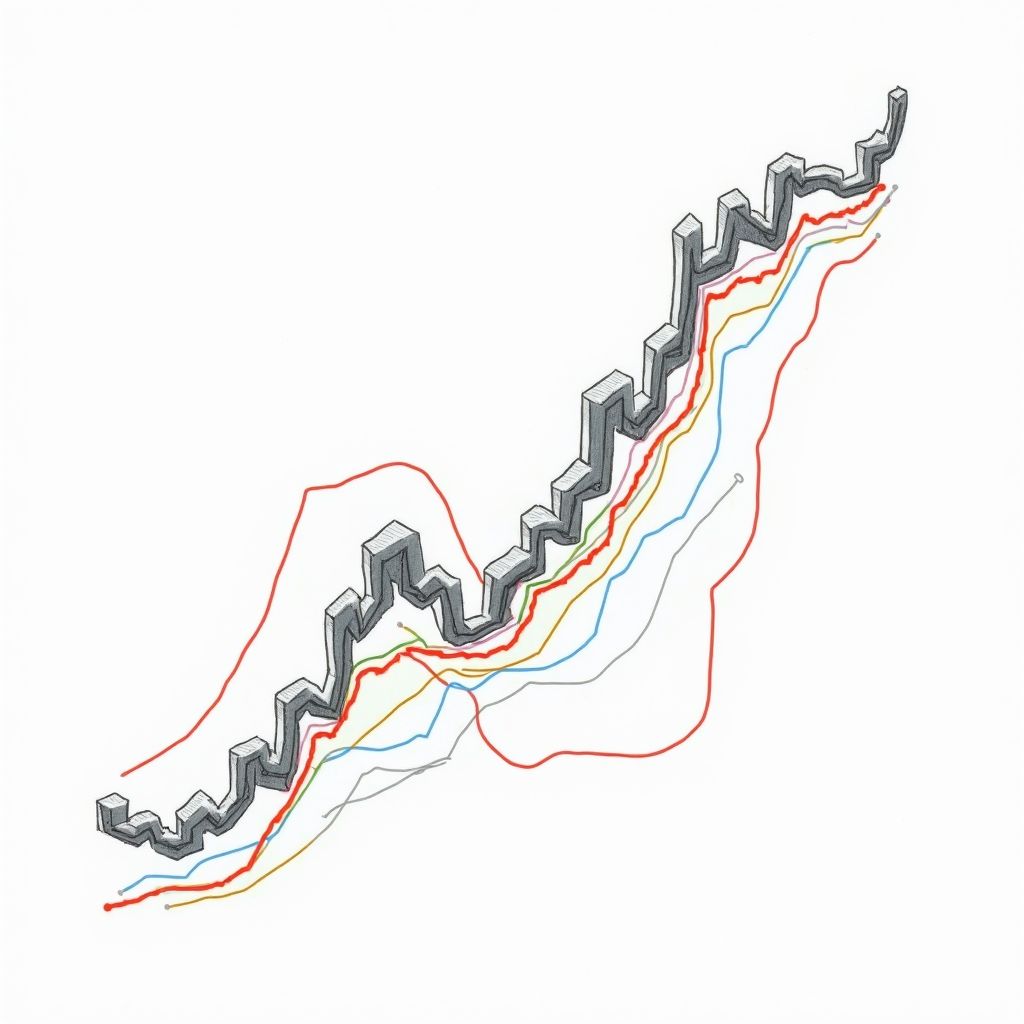

The S&P 500 defied significant headwinds to close 2025 with an approximate 17% gain, marking its third consecutive year of double-digit growth. This resilience is particularly notable given the steep volatility experienced in April, when the index plummeted nearly 19% to the brink of a bear market following President Trump’s global tariff announcements. While equities rallied as the administration pivoted to narrower trade policies, precious metals quietly outperformed, with silver surging over 140% for the year. As investors look toward 2026, the market must navigate elevated valuations and leadership changes at the Federal Reserve, raising questions about the sustainability of this extended rally.

Tech Dominance and Sector Broadening

The S&P 500’s final tally for 2025 reveals a 16.39% advance, securing its third consecutive year of double-digit growth following gains of 24% in 2023 and 23% in 2024 [2]. While the broader market participated, technology continued to drive momentum. The Nasdaq Composite outperformed its peers with a 20.36% surge, while the Dow Jones Industrial Average posted a more modest 12.97% increase [2]. Market concentration remains a focal point for analysts; the top five companies—Nvidia, Apple, Microsoft, Amazon, and Alphabet—now comprise nearly 30% of the S&P 500 index [1]. Alphabet notably distinguished itself as the best-performing member of the “Magnificent Seven,” registering a 65.8% gain for the year [2].

Navigating Policy Shifts and Market Volatility

The year’s gains mask the severe turbulence experienced in the second quarter. In early April, the S&P 500 dropped nearly 19% from its February highs, falling below the 5,000 mark and approaching bear market territory [2]. This sell-off was triggered by President Trump’s announcement of sweeping tariffs, a policy move that rattled global trade expectations [1][2]. The subsequent recovery was driven by the administration’s pivot toward “smarter, more narrow tariffs” with gradual implementation, a strategy that allowed corporate America to adjust supply chains and preserve margins [2]. According to Keith Buchanan, a senior portfolio manager at Globalt Investments, the market has priced in these policy shifts, effectively “banking on the administration remembering those lessons from 2025” as investors look toward 2026 [2].

Economic Indicators and the Housing Slowdown

Underpinning the equity rally is an economy that continues to expand, albeit with emerging signs of labor market softening. The U.S. economy grew at an annual rate of 4.3% in the third quarter of 2025, an acceleration from the 3.8% recorded in the previous quarter [1]. However, the unemployment rate ticked upward to 4.6% in November, reaching its highest level since 2021 [1][8]. This mixed macroeconomic data suggests a complex environment for the Federal Reserve, which must balance growth against lingering inflationary pressures.

Valuation Concerns Entering 2026

As the calendar turns to 2026, valuation metrics are flashing potential warning signals. The S&P 500’s Shiller CAPE ratio stands at 40.7, a level previously seen only during the peak of the dot-com euphoria in 2000 [8]. Furthermore, the index’s forward price-to-earnings multiple of 21.8 is approximately 18% above its 10-year average, suggesting stocks are priced for perfection [8]. This elevated valuation comes as investors prepare for a leadership transition at the central bank, with President Trump expected to name a successor to Federal Reserve Chair Jerome Powell when his term expires in May 2026 [1].

Sources

- www.bbc.com

- www.cnbc.com

- www.cnbc.com

- finance.yahoo.com

- robinhood.com

- www.spglobal.com

- www.spglobal.com

- www.fool.com