AMC Stock Hits Record Lows Despite Best Holiday Box Office Since 2021

Leawood, Friday, 9 January 2026.

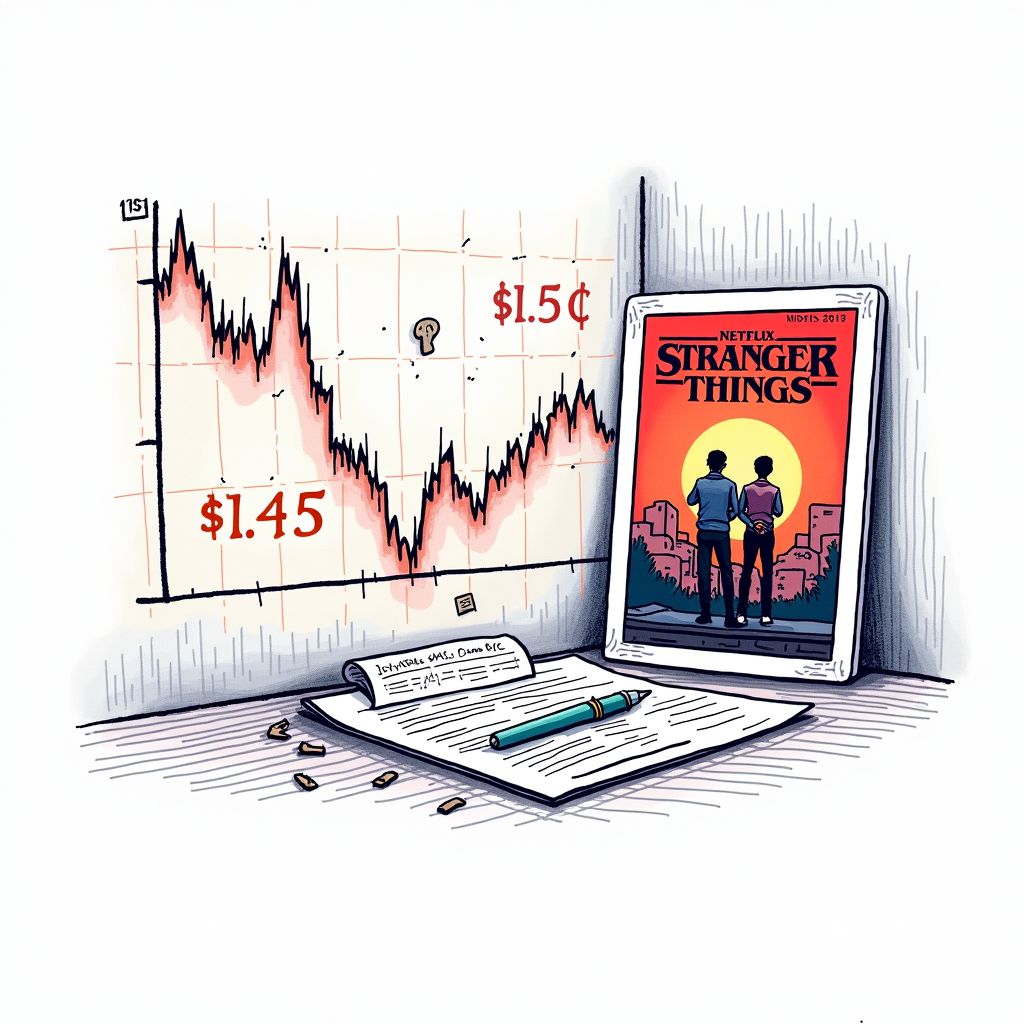

Shares touched historic lows near $1.45, defying an operational resurgence that included hosting Netflix’s Stranger Things finale and achieving its best pre-Christmas box office revenue since 2021.

Market Valuation Disconnect

As of market close on January 9, 2026, AMC Entertainment Holdings (AMC) presents a stark paradox to investors. While the company is capitalizing on a content resurgence, its equity value has eroded to historic lows. The stock traded between $1.45 and $1.70 on Friday, settling at $1.63 [1]. This price action follows a drop to a 52-week low of $1.44, representing a precipitous decline of -64.706% from its yearly high of $4.08 [1]. Despite the bearish sentiment, the underlying business reported its strongest pre-Christmas weekend since 2021, driven largely by the release of Avatar: Fire and Ash, which generated $88 million domestically and drew over 4 million guests [2]. This divergence suggests that while theater attendance is recovering, the market remains deeply skeptical of the company’s long-term capitalization.

Subdued Investor Sentiment

The skepticism is quantifiable in the stock’s recent performance metrics. Over the past year, AMC has delivered a total shareholder return decline of 63.3%, with a sharp 36.4% drop occurring in just the last 30 days leading up to January 8 [3]. Currently, the company holds a market capitalization of approximately $836.1 million [1]. Analysts point to a disconnect between the trading price and the company’s fundamentals; for instance, some valuation models suggest a fair value of $3.34, significantly higher than current trading levels [3]. However, the market’s hesitation appears rooted in broader financial health concerns rather than immediate box office receipts.

A Strategic Pivot: The Netflix Collaboration

In an effort to diversify revenue streams and maximize theater utilization, AMC has notably warmed its relationship with streaming giant Netflix. This strategic shift was highlighted by the screening of the Stranger Things series finale across 231 U.S. locations in late 2025, which attracted over 753,000 attendees [4]. The demand was robust enough that AMC allocated nine times the originally envisioned seating capacity for the event [4]. This follows a successful trend of alternative content; in August 2025, a theatrical event for Netflix’s KPop Demon Hunters sold out over 1,300 theaters and reached the number one spot at the box office [4]. These collaborations mark a significant departure from the historical friction between exhibitors and streamers regarding theatrical windows.

Financial Realities and Future Outlook

Despite operational wins in content exhibition, AMC’s balance sheet remains a primary point of friction for institutional investors. As of September 2025, the company reported total liabilities of $9.80 billion against total assets of $8.02 billion, resulting in a shareholder equity deficit of -$1.78 billion [5]. The company also reported a net income loss of $298.20 million for that quarter [5]. To manage liquidity, AMC recently sold the majority of its stake in Hycroft Mining for $24.1 million [2]. Looking ahead, the company is preparing for its next earnings report on February 24, where analysts estimate revenue of $1.41 billion but expect a continued loss of 5 cents per share [2]. Furthermore, an amended note agreement allows for up to $150 million in stock offerings beginning in February 2026, which may be contributing to fears of further share dilution [2].