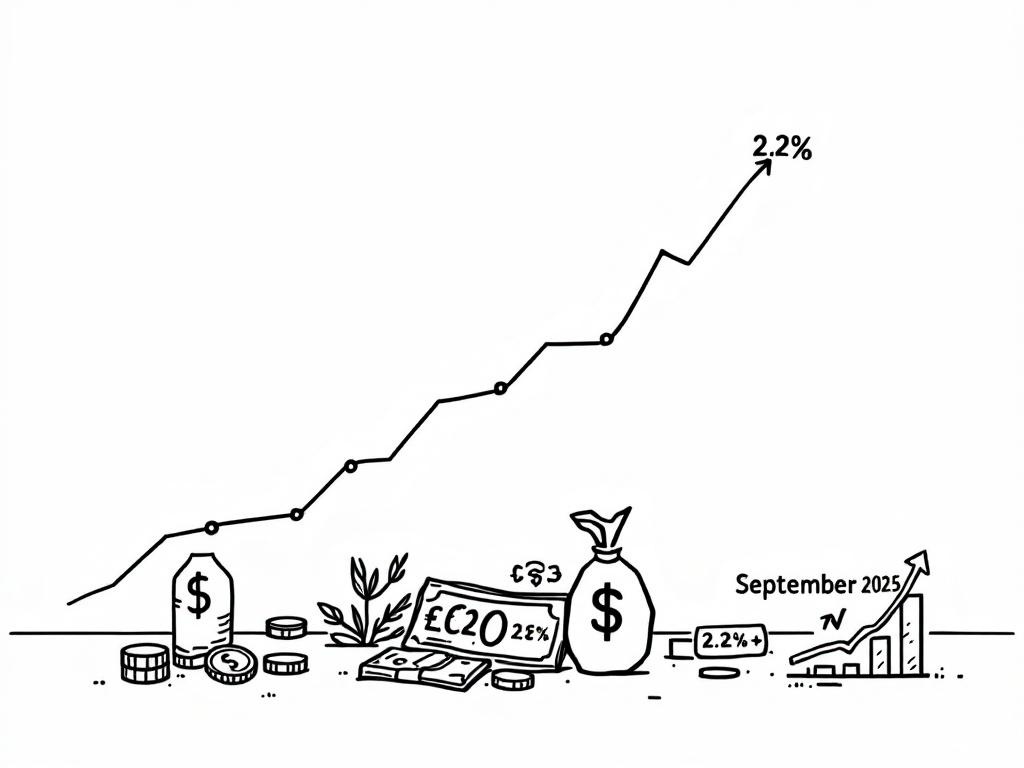

Eurozone Inflation Rises to 2.2% in September 2025, Global Markets Impacted

Brussels, Friday, 17 October 2025.

Euro area inflation reached 2.2% in September, up from 2.0% in August, driven by rising costs in services and essentials, with implications for global markets amid economic stability concerns.

Inflation Dynamics and Contributing Factors

The euro area inflation rate reached 2.2% in September 2025, a rise from 2.0% in August, according to Eurostat. This increase is largely driven by rising costs in services, which contributed 1.49 percentage points to the overall inflation rate. Food, alcohol, and tobacco also played a significant role, adding 0.58 percentage points. Meanwhile, energy prices, which have often been a deciding factor, contributed negatively to inflation, subtracting 0.03 percentage points [1].

Regional Disparities in Inflation Rates

Inflationary pressures vary significantly across the eurozone, with Romania experiencing the highest inflation rate at 8.6%, followed by Estonia at 5.3%. In contrast, Cyprus reported no inflation, and France saw a modest 1.1% increase. These disparities highlight the uneven economic recovery and varying economic conditions across the region [1].

Impact on Global Markets

The rise in euro area inflation has ramifications beyond the region, influencing global markets and investor sentiment. With inflation climbing, there is heightened scrutiny on the European Central Bank’s potential monetary policy adjustments. The euro’s exchange rate against the US dollar exhibited volatility, with the EUR/USD declining to 1.1662, a decrease of 0.22% from the previous session [3][6].

Implications for Monetary Policy

As inflation trends upward, the European Central Bank faces the challenge of balancing price stability with economic growth. The ECB may consider interest rate adjustments to curb inflation, which could affect lending rates and economic activity. Current discussions indicate a possibility of rate cuts in the US, adding complexity to the global financial landscape as investors weigh these dynamics [2][5].

Sources

- ec.europa.eu

- data.ecb.europa.eu

- www.ecb.europa.eu

- tradingeconomics.com

- tradingeconomics.com

- uk.finance.yahoo.com