Oil Markets Remain Steady as Iran Temporarily Closes Strait of Hormuz During Nuclear Talks

Tehran, Tuesday, 17 February 2026.

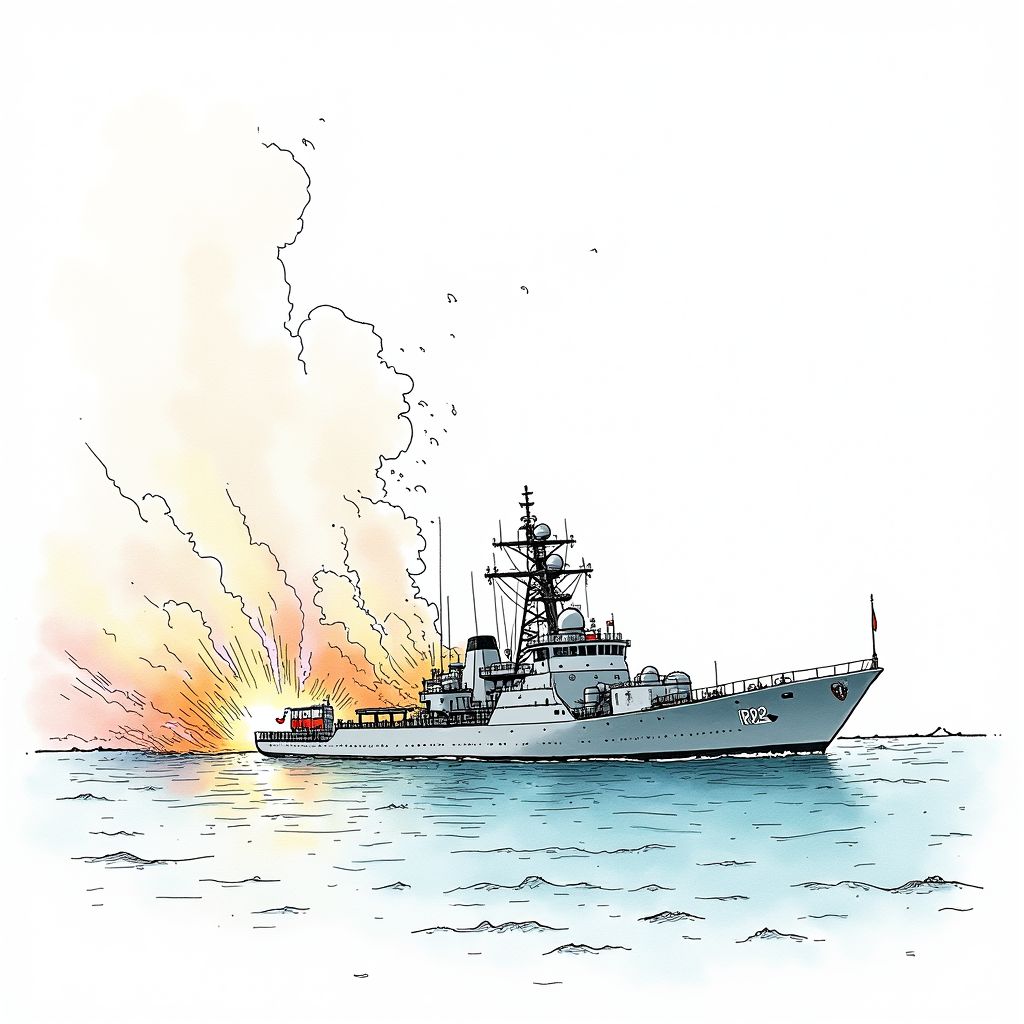

On Tuesday, February 17, the Islamic Revolutionary Guard Corps (IRGC) initiated live-fire naval drills in the Strait of Hormuz, resulting in the temporary closure of this vital global oil artery. This strategic military posturing occurs precisely as indirect nuclear negotiations between the United States and Iran resume in Geneva, highlighting a tense interplay between diplomacy and military brinkmanship. Despite the disruption to a waterway responsible for one-third of seaborne crude exports, global oil markets have exhibited surprising stability, with prices fluctuating only slightly. This measured market response suggests investors currently interpret the drills as a calculated negotiation tactic rather than an immediate precursor to conflict. However, with the IRGC testing weapons described as distinct from their wartime arsenal, the geopolitical risk premium remains a critical factor for energy investors to monitor closely.

Market Resilience Amidst Maritime Tension

Financial markets have demonstrated remarkable resilience in the face of the Islamic Revolutionary Guard Corps’ (IRGC) latest military maneuvers. By 8:45 a.m. ET on Tuesday, U.S. West Texas Intermediate (WTI) crude had risen by 53 cents, or 0.84%, trading at $63.42 per barrel, while the global benchmark Brent crude actually saw a slight decline of 29 cents, or 0.42%, settling at $68.36 [1]. This muted reaction is particularly notable given that the Strait of Hormuz is the world’s most critical oil transit chokepoint, facilitating the passage of approximately one-third of all waterborne crude oil exports [1]. The stability in pricing suggests that traders are currently pricing in these events as geopolitical theater rather than an imminent supply chain disruption, despite the waterway connecting major producers like Saudi Arabia, Iraq, and the UAE to global markets [2].

Calculated Military Signaling

The drills, which involved the firing of live missiles and a temporary suspension of traffic for several hours, were officially framed by Iranian sources as necessary for “security precautions” and shipping safety [2][3]. However, the rhetoric accompanying the exercises points to a sharper strategic intent. The IRGC Navy commander explicitly stated that “the weapon that reaches the battlefield on the day of war is different from what is displayed in exercises,” a clear message regarding Iran’s latent military capabilities [4]. This display of force follows a similar pattern to a drill conducted several weeks ago, though notably, that previous exercise did not include the announcement of strait closures [3]. The coordination of these drills with diplomatic events underscores a strategy of leverage, aiming to project strength even as negotiators sit down in Europe.

Diplomacy in the Shadow of War Games

As naval forces maneuvered in the Persian Gulf, the second round of indirect nuclear negotiations between the United States and Iran commenced in Geneva, Switzerland, on Tuesday, February 17 [1][3]. These talks follow an initial round held in Oman on February 6 and are taking place in an atmosphere of heightened pressure [3]. Iranian Foreign Minister Abbas Araghchi, who met with the head of the U.N. nuclear watchdog agency in Geneva on Monday, set a defiant tone for the proceedings. “I am in Geneva with real ideas to achieve a fair and equitable deal,” Araghchi stated, adding that “submission before threats” is not on the table [3]. According to Iranian reporters present at the venue, the discussions have now entered a “technical phase,” suggesting a move toward the minutiae of compliance and sanctions relief despite the friction [5].

The Geopolitical Risk Premium

The backdrop to these technical discussions is a volatile security environment. U.S. President Donald Trump has previously threatened strikes on the Islamic Republic if a deal regarding its nuclear program is not reached, asserting that while Iran wants a deal, they do not want the “consequences of not making a deal” [1][3]. Conversely, U.S. Secretary of State Marco Rubio adopted a more cautious stance regarding the Geneva meetings, noting he would not “prejudge these talks” and emphasizing that the president prefers peaceful, negotiated outcomes [3]. While the oil markets remain calm for the moment, the simultaneous execution of live-fire drills and high-stakes diplomacy creates a narrow margin for error, where a single miscalculation in the Strait could rapidly alter the economic landscape.