Interfor to Reduce Lumber Production by 26% in Q4 2025

Burnaby, Friday, 17 October 2025.

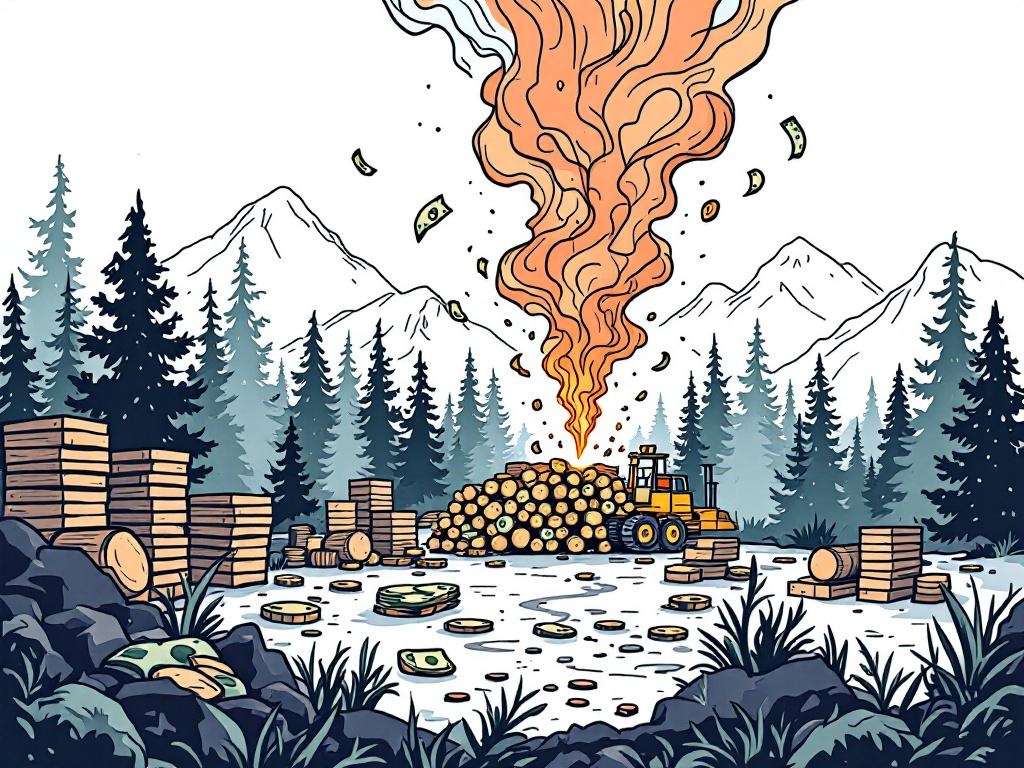

Interfor Corporation will curtail lumber production by 26% in Q4 2025 due to weak market demand and supply chain issues, affecting both Canadian and U.S. operations.

Rationale Behind Production Curtailments

Interfor Corporation, trading on the Toronto Stock Exchange under the ticker symbol IFP, announced a strategic decision to reduce its lumber production by 26% for the fourth quarter of 2025. This move is a response to ongoing challenges including weak market demand and persistent supply chain disruptions. The curtailments will affect both Canadian and U.S. operations, with production expected to decrease by approximately 250 million board feet. This reduction is significant when considering Interfor’s quarterly production figures of 936 million board feet in Q2 2025 and 910 million board feet in Q3 2025 [1][2].

Impact on Market and Company Operations

The decision to curtail production aligns with a broader industry trend where lumber prices in North America have been declining from already low levels. This economic environment has put pressure on forest product companies to adjust their operations to maintain financial stability. Interfor, recognized as a growth-oriented forest products company, has an annual lumber production capacity of approximately 4.7 billion board feet, which underscores the significance of the planned reductions [1][3].

Economic and Political Context

Interfor’s curtailment announcement comes amidst heightened economic uncertainties exacerbated by U.S. trade policies. Recent impositions of a 45% cumulative tariff on Canadian softwood lumber, including a 10% tariff effective October 14, 2025, have further strained the market. These tariffs are part of a broader set of trade measures that have increased costs for Canadian producers and complicated cross-border trade dynamics [4][6].

Future Projections and Industry Outlook

Looking forward, Interfor plans to closely monitor market conditions and adjust its production plans accordingly. The company remains committed to navigating these challenges by leveraging its operational flexibility across North America. Industry stakeholders are keenly observing how enduring tariffs and fluctuating market demands will shape the forest sector’s trajectory in the coming months. Analysts suggest that without significant policy changes or market recovery, companies like Interfor may face prolonged operational adjustments [1][5][7].

Sources

- www.globenewswire.com

- ca.marketscreener.com

- stockanalysis.com

- www.cbc.ca

- treefrogcreative.ca

- woodcentral.com.au