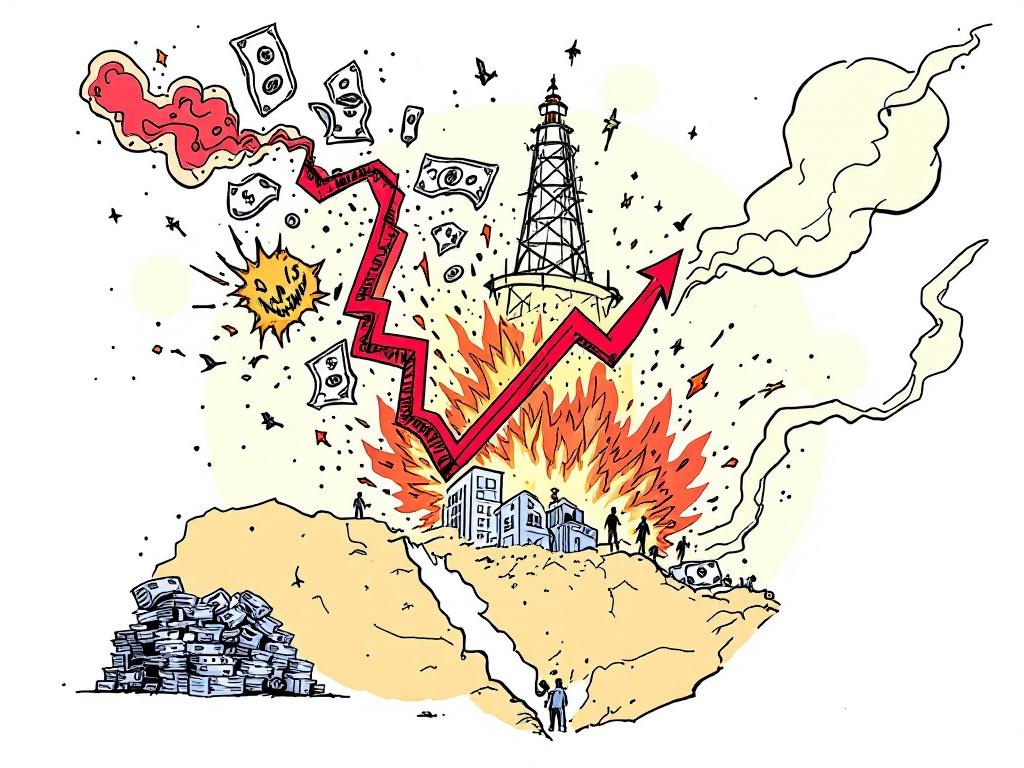

Middle East Conflict Spurs Oil Price Surge and Inflation Concerns

New York City, Tuesday, 17 June 2025.

Tensions between Israel and Iran stir fears of inflation as oil prices climb. Brent Crude peaks over $78 per barrel before settling at $74.50. Watch for market volatility.

Impact on Oil Prices and Inflation

The recent military conflict between Israel and Iran has led to significant disruptions in the global oil market, with Brent Crude prices initially spiking to over $78 per barrel before stabilizing around $74.50 as of 11 June 2025. This movement is observed against a backdrop where the geopolitical tension in the Middle East consistently leads to energy price hikes, which contribute to inflationary pressures across global markets. The elevated oil prices are reminiscent of the post-Ukraine conflict inflationary trends, where similar hikes impacted not only energy costs but also extended to food and consumer goods prices globally [1][2].

Economic Ramifications and Market Reactions

Economic analysts underscore the potential for inflation to ascend with persistent higher energy prices impacting essential sectors such as farming, transportation, and food production, ultimately affecting consumer prices. This highlights a direct correlation where a $10 increase in crude oil prices could potentially elevate inflation by 1% across advanced economies, according to estimates from Capital Economics [2]. Investors have become more cautious as market volatility intensifies, with global equities, particularly the ASX, experiencing turbulent fluctuations amid these geopolitical developments [1][2].

Central Bank Policy and Investor Strategies

Despite the soaring oil and gold prices, experts suggest that central banks, including the U.S. Federal Reserve, are likely to maintain the possibility of interest rate cuts. The Federal Reserve is expected to keep the federal funds rate steady at its meeting on June 18, 2025, while monitoring inflation and market conditions closely. Furthermore, the likelihood of rate reductions by September is estimated at 60%, with an 88% chance for at least two cuts by the year’s end [3][4]. In light of these dynamics, investors are advised to consider strategic adjustments such as overweighting currencies like USD/JPY and USD/CHF, which benefit from flight-to-safety sentiments amid rising uncertainty [4].

Outlook for Commodities and Global Trade

As the crisis unfolds, oil and gas companies witness stock surges, driven by uncertainties about energy supply stability. Concurrently, this positions gold as a preferred asset amidst market instability, with prices soaring to unprecedented highs nearing $3,500 per ounce [1][3]. Accounting for these economic adjustments, commodities’ price increases may lead to boosts in government tax revenues, particularly in Australia, potentially stabilizing part of the federal budget [3]. However, threats to critical transit routes such as the Strait of Hormuz remain a pivotal concern, with roughly 20% of the world’s oil supply passing through these waters [3]. Should physical disruptions manifest, further escalations in energy prices could ensue, exacerbating current inflationary pressures [1][2][3].