Supreme Court Scrutinizes Presidential Authority to Direct Central Bank Policy

Washington D.C., Friday, 16 January 2026.

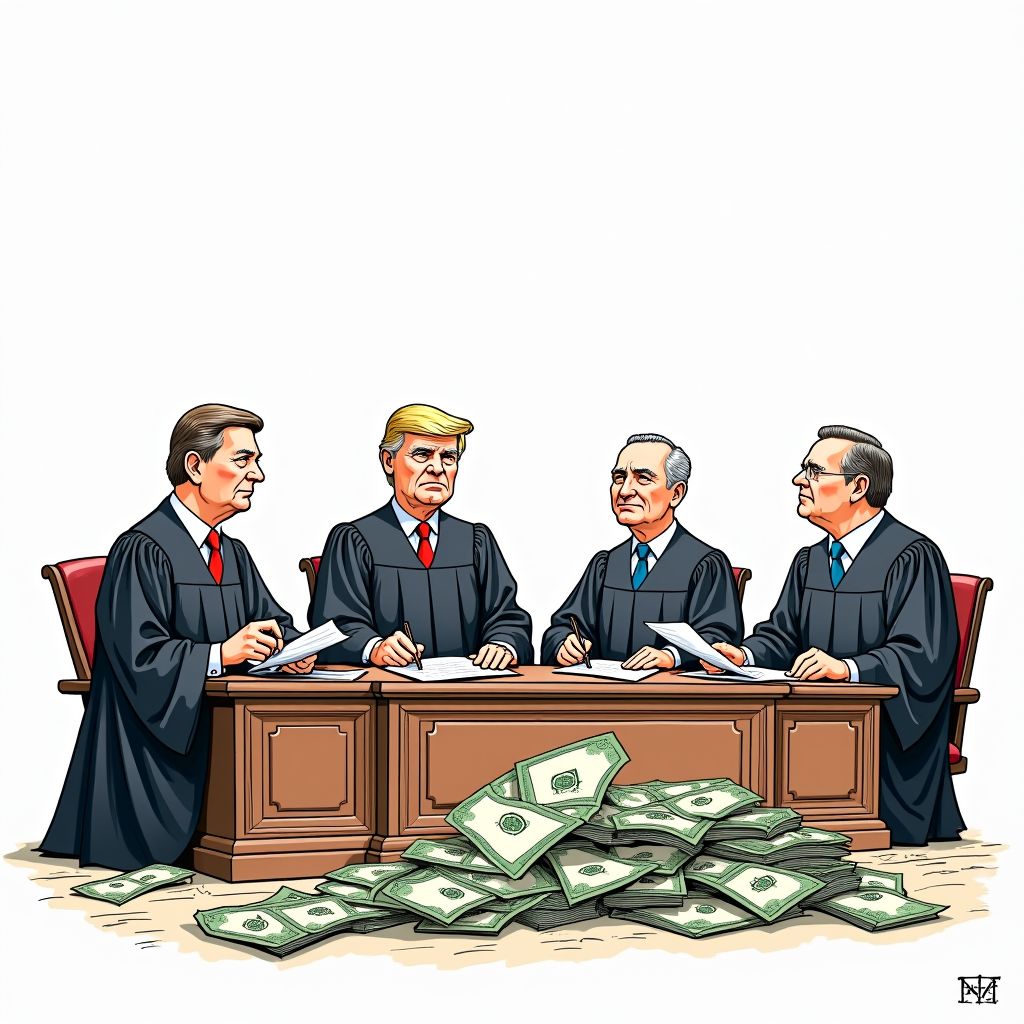

Justices will decide if the President can control Fed policy, a power shift economists warn parallels the destabilizing political interference seen in emerging markets.

Constitutional Showdown Escalates Beyond Renovation Probe

The conflict over the governance of the United States’ central bank has rapidly intensified, moving from a targeted criminal inquiry into broad constitutional litigation. As previously reported, the Department of Justice recently opened a criminal investigation into Federal Reserve Chair Jerome Powell regarding testimony on headquarters renovation costs [1]. However, the scope of the executive branch’s challenge to the Fed’s autonomy will undergo its most significant test this coming Wednesday, January 21, when the Supreme Court hears oral arguments regarding the President’s attempt to remove Governor Lisa Cook [2]. The administration moved to dismiss Cook in August 2025, a decision that legal scholars and economists argue could dismantle the “for cause” protection that currently shields the Board of Governors from political whims [3][4].

Market Jitters Over Unprecedented Policy Interventions

While the Supreme Court weighs the legal structures of independence, the financial sector is already reacting to the administration’s proposed policy interventions. Beyond the pressure on personnel, President Trump has proposed a federal cap on credit card interest rates of 10%, a policy he aims to have in place by January 20 [9]. This proposal sent shockwaves through the markets on January 13, causing shares of major credit issuers like American Express, JPMorgan, and Citigroup to fall sharply [9]. A study by Vanderbilt University researchers estimates that such a cap would cost banks approximately $100 billion annually, fundamentally altering the profitability of consumer lending [9]. Wall Street executives, usually supportive of the administration’s deregulatory agenda, have issued stark warnings; JPMorgan Chase CEO Jamie Dimon cautioned on January 14 that undermining the Fed’s independence would likely destabilize bond markets [5]. President Trump dismissed these concerns the following day, suggesting Dimon’s defense of the Fed was motivated by a desire for higher interest rates to boost bank profits [7].

Global Central Bankers Rally Amidst Internal Discord

The domestic struggle has triggered an unusual intervention from the global financial community. On January 13, more than a dozen central bank leaders, including European Central Bank President Christine Lagarde, signed a joint statement supporting Powell and the principle of central bank independence [5][8]. This international solidarity has created diplomatic friction; New Zealand’s Foreign Minister, Winston Peters, publicly rebuked his country’s central bank governor for signing the letter, calling it an inappropriate involvement in U.S. domestic politics [7]. Inside the Federal Reserve, the divide is deepening. Governor Stephen Miran, a former economic adviser to President Trump who joined the board last year, broke ranks with his international colleagues on January 15, labeling the foreign statement as “inappropriate” for central bankers [5]. This internal fracture highlights the precarious position of the Board as it awaits the Supreme Court’s guidance on its future composition.

Economic Stakes and the Path Forward

The battle for control comes at a delicate moment for the U.S. economy. Inflation currently stands at 2.8%, hovering above the Fed’s 2% target, while the benchmark interest rate is set between 3.5% and 3.75% [8][10]. President Trump has publicly demanded rates be slashed to 1% or lower, a move economists warn could reignite inflation reminiscent of the 1970s [8][10]. While the President stated on January 15 that he has no immediate plans to fire Powell—whose term as Chair expires in May 2026—Powell retains a separate seat on the Board of Governors that does not expire for another two years [6]. This allows Powell to remain a voting member on the Federal Open Market Committee even if he is replaced as Chair, potentially setting up a prolonged internal struggle over monetary policy well into the future [6].

Sources

- wsnext.com

- talkingpointsmemo.com

- www.bbc.com

- theconversation.com

- www.politico.com

- www.reuters.com

- www.theguardian.com

- theconversation.com

- www.pbs.org

- abcnews.go.com