Universal Orlando Faces Backlash Over Operational Shortfalls and Influencer Exclusivity

Orlando, Monday, 9 February 2026.

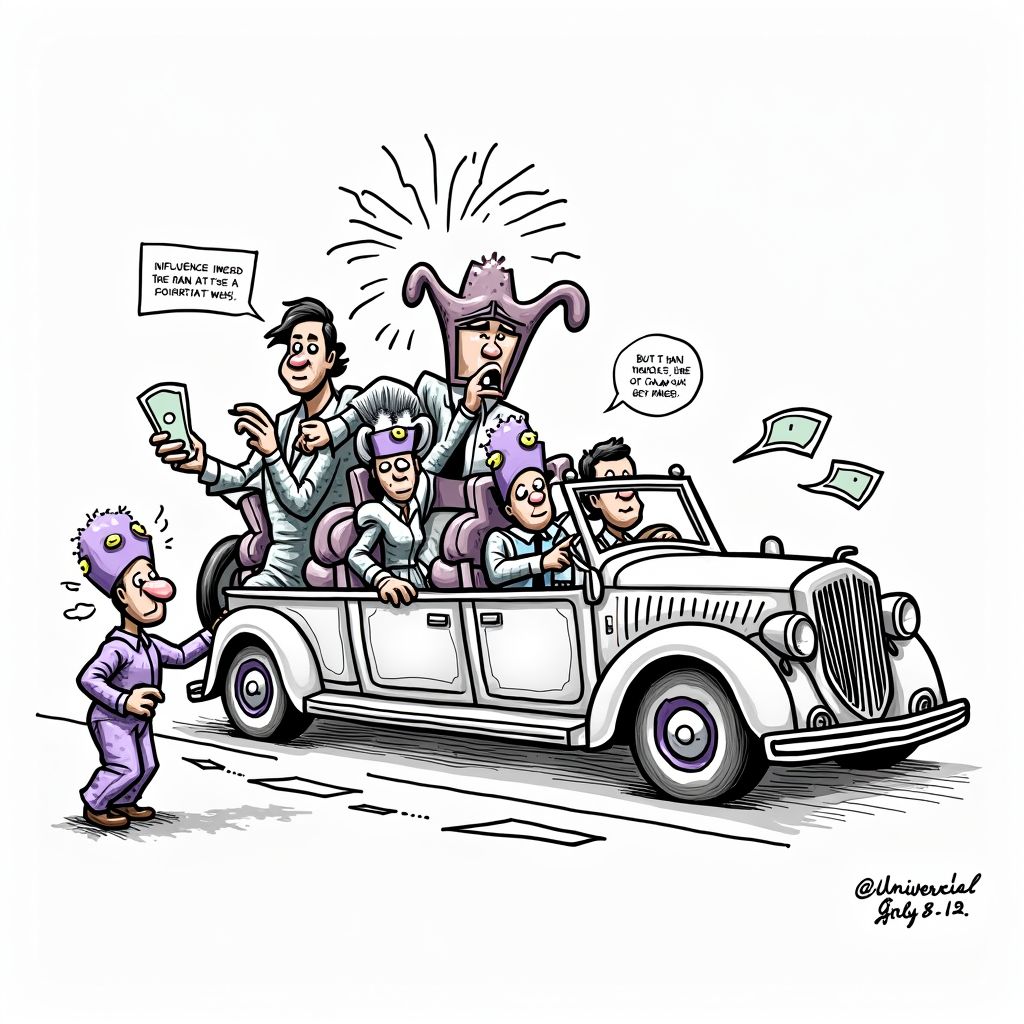

Universal launched its Mardi Gras parade with just eight of twelve scheduled floats, highlighting operational challenges and growing guest frustration regarding the prioritization of influencer access over paying customers.

Operational Discrepancies Define Opening Weekend

The commencement of the 2026 Mardi Gras season at Universal Orlando Resort, a subsidiary of Comcast (CMCSA), was marked by significant deviations from the advertised experience. Reports from the opening events indicate that the signature Mardi Gras parade operated at a significantly reduced capacity. specifically, only 8 of the 12 scheduled floats appeared during the procession on February 6 and February 7 [1]. Furthermore, the interactive element of the parade—a key selling point for the event—was severely curtailed, with only 3 of the operating floats featuring bead throwers [1]. This reduction represents a shortfall of 33.333% in the expected float lineup, leading critics to suggest that the “bill of goods” sold via promotional materials did not align with the on-the-ground reality for full-price ticket holders [1].

The Influencer Economy vs. Guest Experience

Beyond the logistical constraints, a distinct friction has emerged regarding the tiered access provided to social media influencers versus standard guests. The debut of “Prince Gator,” a new character and son of the fan-favorite King Gator, was managed with an “influencer-first” strategy [1]. While media personalities and content creators were granted early access to the character, standard ticket holders were unable to view Prince Gator until approximately 20:00 on February 6, merely one hour prior to the park’s closing [1]. This disparity highlights a growing trend in the theme park industry where viral marketing moments are prioritized, occasionally at the expense of the general guest experience. The character’s debut was centered around “The Wave” near the Horror Make-Up Show, but the limited window for general public interaction has fueled the narrative of exclusivity over accessibility [1].

Financial Implications and Product Value

The operational shortfalls raise questions regarding the value proposition for premium add-ons associated with the event, which is scheduled to run through April 4, 2026 [2][6]. Universal monetizes the parade experience through the “Mardi Gras Float Ride and Dine Experience,” which starts at a price point of $94.99 [6]. With the parade operating at reduced capacity and bead interactions limited, the intrinsic value of these upsell packages may be scrutinized by consumers. While annual passholders are offered a 15% discount on such experiences, the core product’s delivery remains critical for maintaining consumer trust and recurring revenue in the competitive Orlando tourism market [6].

Culinary and Retail Segments Remain Strong

Despite the backlash surrounding the parade and character operations, the “International Flavors of Carnaval” component of the festival has garnered positive initial reception. The event features over 40 food options inspired by global cuisines, with specific praise directed at items such as the Pinchos de Lechon from Puerto Rico and the Mala Beef Skewer from China [2]. Additionally, the retail strategy appears robust; the 2026 Tribute Store, themed as “TonTon’s Roadhouse,” has opened in the Hollywood section of the park, offering a highly themed retail environment that mimics a Louisiana watering hole and back alley [6]. Merchandise sales, driven by items like beignet plushies, continue to be a significant revenue driver, with reports indicating these items are performing well with attendees [5]. As the event progresses toward its April conclusion, the ability of Universal Orlando to align its operational delivery with its culinary and retail successes will be pivotal in mitigating the initial negative sentiment.