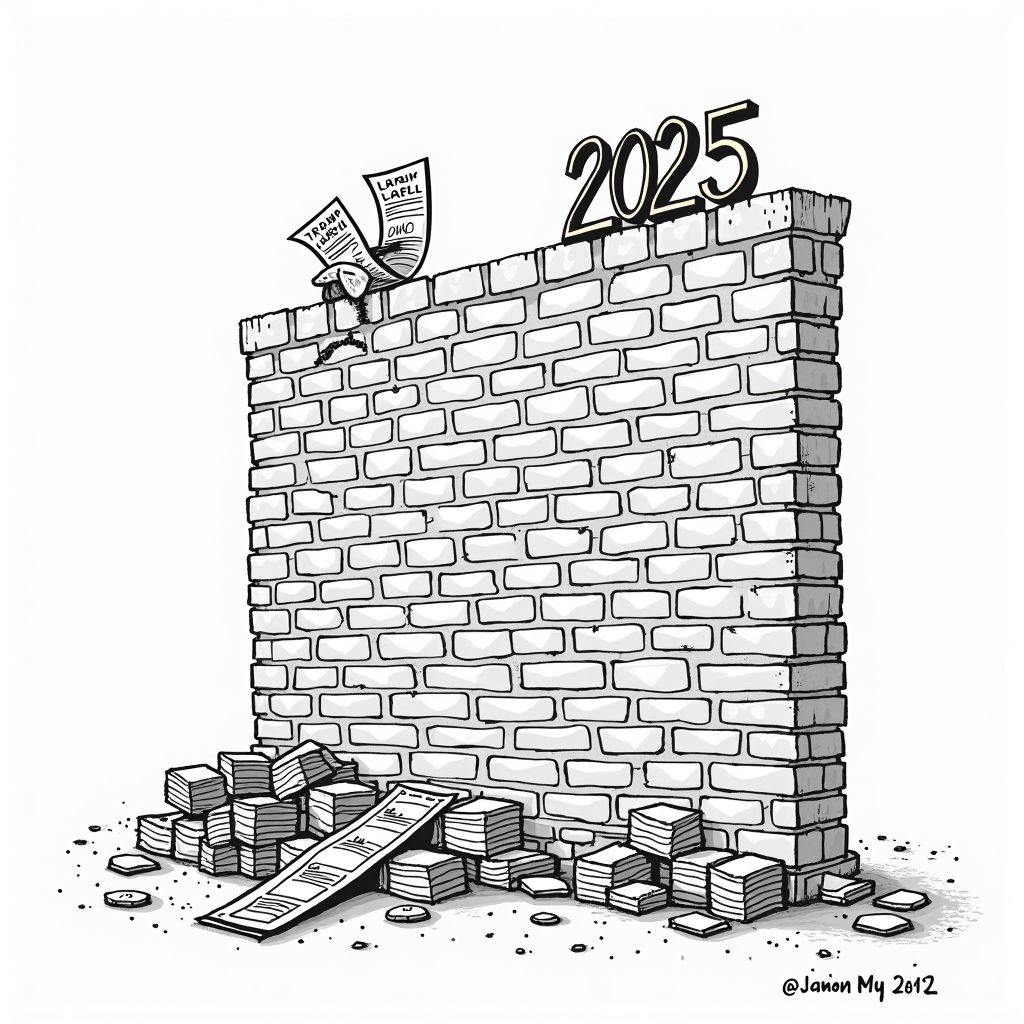

The 2025 Tariff Wall: How Protectionist Policies Are Reshaping the American Economy

Washington, Friday, 26 December 2025.

In a historic pivot from open markets, 2025 defined a new economic era as the Trump administration erected a comprehensive “wall of tariffs,” pushing effective rates to nearly 17%—levels unseen since 1935. This protectionist strategy generated over $250 billion in federal revenue by year’s end but triggered extensive retaliatory measures from key trading partners like China and the EU. Perhaps the most palpable shift for consumers was the elimination of the de minimis exemption, effectively ending tax-free low-value imports and disrupting global e-commerce logistics. While the Supreme Court deliberates the legality of these executive moves, the immediate result is a structurally altered economy where domestic industry protection takes precedence over global integration, forcing businesses to rapidly overhaul their supply chains in a volatile marketplace.

Structural Shifts in Fiscal Policy

The administration’s overhaul of trade policy has fundamentally reconfigured the nation’s fiscal landscape. By December 18, 2025, customs and excise taxes had generated $358.6 billion, accounting for 7.5% of total federal revenue [2]. This surge in receipts tracks with a dramatic escalation in the average applied U.S. tariff rate, which rose from 2.5% in January to an estimated 27% by April [2]. While these measures have bolstered the Treasury, they have also compressed the U.S. trade deficit. After peaking at $136.4 billion in March 2025, the deficit narrowed to $52.8 billion by September [1], representing a sharp reduction of 61.29% in just six months.

Industry Disruption and Supply Chain Fractures

The manufacturing sector has faced acute volatility as the administration leveraged the International Emergency Economic Powers Act (IEEPA) to impose “reciprocal tariffs” on nearly all imports [2]. The automotive industry, deeply integrated across North American borders, absorbed a significant blow when a 25% tariff on imported cars—including those from Mexico and Canada—took effect on April 3 [2]. The industrial fallout was immediate: Stellantis announced temporary factory closures and the layoff of 900 American employees, while Ford CEO Jim Farley warned that the long-term effects would “blow a hole” in the domestic industry [2]. Furthermore, the broader implementation of a 10% universal tariff on April 5 [2] has forced companies to rapidly reassess their reliance on foreign materials.

Consumer Costs and Legal Uncertainty

Beyond the industrial sector, American consumers are confronting a new reality following the global termination of the de minimis exemption on August 29, 2025 [2]. Previously allowing duty-free imports on packages valued under $800, the removal of this exemption has prompted major retailers to warn of inevitable price increases and shortages [2]. As the year concludes, the permanence of these policies remains legally precarious. Although federal courts ruled earlier in the year that the administration exceeded its authority under the IEEPA, the Supreme Court heard oral arguments on the matter on November 5, 2025, with a final decision still pending [2].

Summary

As 2025 draws to a close, the data reveals a bifurcated economy: federal coffers are bolstered by record tariff revenues, yet industries and consumers grapple with higher costs and supply chain instability. The coming year will likely hinge on the Supreme Court’s ruling regarding the IEEPA, determining whether this protectionist fortress becomes a permanent fixture of American commerce.